Since its inception in 2015, Ample has raised more than $4m from venture capital and angel investors, but in order to bui...

Problem

Our hectic schedules force us to choose convenience over health

Our lifestyles today are more complex and unpredictable than ever. With demanding careers, social commitments, staying fit, and a whole lot more, we juggle long to-do lists that can feel overwhelming.

We all know our health is vitally important, but when we're busy, we sometimes find ourselves reaching for convenient food options that, while fast—just don’t cut it.

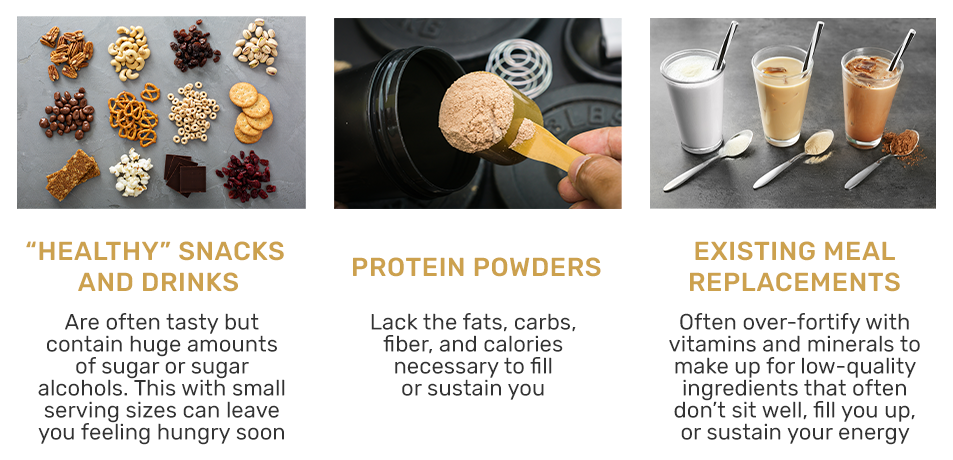

Current "healthy" convenience foods fall short.

All of these product categories leave something to be desired. But trading our health for convenience or taste should not be a compromise we have to make.

We’re ready for better.

Solution

Ample: Optimal Nutrition, Simplified.

Introducing Ample: a delicious, full meal optimized for short-term energy and long-term wellness that keeps you full for 4+ hours, all in a convenient, shelf-stable form.

Made from 20+ high-quality ingredients backed by sound science, Ample's three High-Protein, Ketogenic, and Plant-Based formulas combine the pillars of a healthy meal—real food sources and well balanced macros—with all the extras you need to truly support wellness: pre- and probiotics, antioxidants, and targeted micronutrients.

Ample is your perfect nutritional sidekick as you navigate life’s uncertainties, so that you can invest more time and focus each day into what matters most.

Just add water, mix, and enjoy!

Product

High-quality ingredients

In each Ample, you'll find complete proteins from quality sources, premium fats like coconut and macadamia, organic greens, prebiotic fiber, and 6 strains of probiotics. All with just 4 grams of sugar or less per 400-calorie meal.

Built on sound science

It was mission-critical that Ample aligned with sound nutritional science to promote foundational pillars of health: gut health, hormone response, inflammation, and oxidation.

The end result: a complete meal designed to support digestion, immunity, brain health, and longevity that leaves you feeling satisfied and energized for 4+ hours.

We did the legwork to make eating well a no-brainer.

Four great-tasting products to suit a variety of diets

See complete product and nutrition information for Ample Vanilla, Ample V Berry, and Ample K Vanilla Cinnamon and Chocolate.

What our nutrition advisors are saying

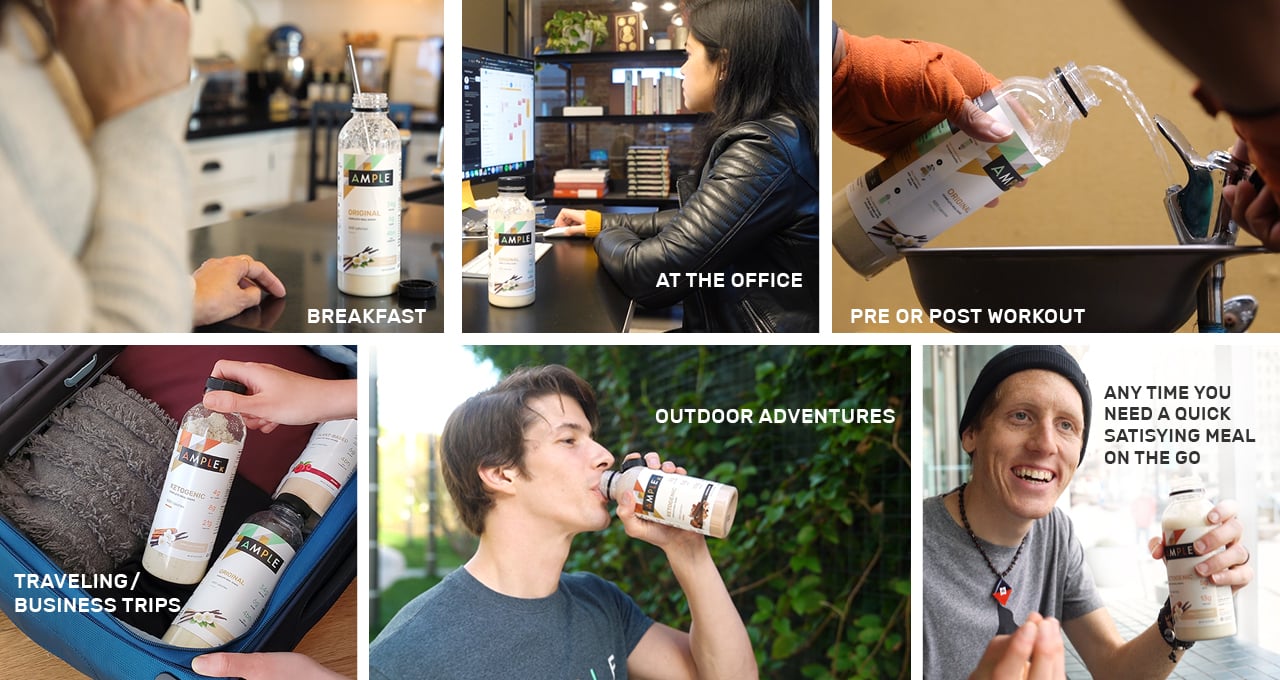

Optimized for convenience, portability and reliability

Ample comes as a shelf-stable dry powder, pre-portioned and sealed in its own 400- or 600-calorie recyclable bottles, or bulk product.

Bottles: Ample’s pre-portioned powder bottles are TSA-compliant for air travel, can be customized with water, milk, or coffee, and save on shipping costs with no water weight. Just toss it in your bag and you’ve got a healthy, nutritious meal that’s ready to go wherever the day takes you.

Bulk Canisters: Since our Republic campaign last year, we’ve introduced a bulk format that allows you to customize your meal size, or to be used as the base for a healthy smoothie at home, while reducing plastic usage.

Designed for modern life

Because of its convenience and portability, customers easily integrate Ample into various usage occasions of their daily routine, leading to happy, high lifetime-value customers.

Optimized for foundational health

Gut microbiome, hormone response, inflammation & oxidation are the key biological areas that set the stage for optimal short and long-term health, no matter the circumstances.

Here’s how we designed Ample with these in mind:

Good for your gut - A healthy gut microbiome improves our immune system, hormones, brain function, and even gene expression. Ample was designed to feed the “good” bacteria with fiber, prebiotics, and probiotics, while starving the “bad” bacteria of sugar and low quality, overly-processed nutrients.

Maintaining proper hormonal responses - Insulin spikes and leptin resistance can lead to obesity, diabetes, energy crashes, and prevent us from feeling full. Ample combats this by keeping sugars and carbohydrates low, and including multiple forms of fiber that slow down digestion. This allows for energy levels to remain stable while keeping hunger at bay.

Controlling inflammation and oxidation - Chronic inflammation and free radical damage are a major cause of chronic diseases such as obesity, diabetes, and Alzheimer’s. We designed Ample to be low in omega-6, sugar and carbs, and minimized ingredient processing to keep inflammation at bay, while containing ingredients that naturally boost antioxidants to fight free radicals.

Ample’s superior formulation passes the test of even the most nutritionally educated consumers, and is convenient and tasty enough for anyone to benefit from.

Traction

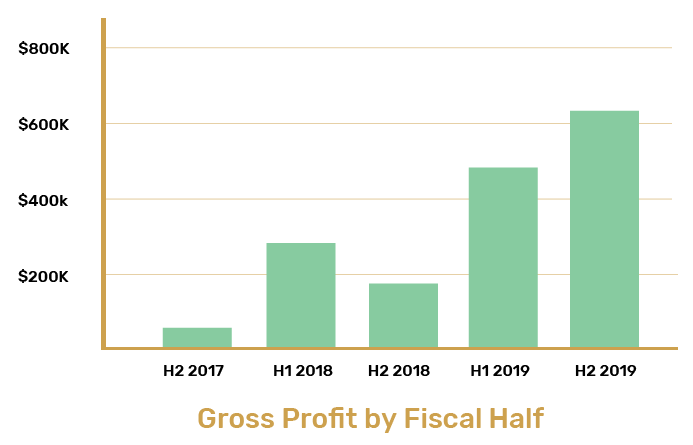

Cash flow positive, 140% increase in yearly gross profits

Fueled by our loyal customer base and substantial margin improvements, gross profits have more-than-doubled through our $3M sales channels on Amazon and our website. This has led us to becoming cash flow positive, allowing for efficient and meaningful use of investment funds.

Predictable Subscription Revenue. Category-Leading Customer Lifetime Value

Ample quickly becomes a staple in our customer’s diets—creating loyal, high-value consumers and predictable revenue streams.

New, High-Demand Products

Since our campaign last year, we’ve released bulk versions of all three of our formulas to resounding success. These bulk containers allow customers to reduce plastic bottle usage, and allow for a more customizable form factor while reducing the per-meal cost to the consumer, and already account for more than 40% of our sales. Likewise, our Ample K Chocolate flavor is seeing similar success, trending toward 50% of all Ample K sales within four months after its launch.

Since our campaign last year, we’ve released bulk versions of all three of our formulas to resounding success. These bulk containers allow customers to reduce plastic bottle usage, and allow for a more customizable form factor while reducing the per-meal cost to the consumer, and already account for more than 40% of our sales. Likewise, our Ample K Chocolate flavor is seeing similar success, trending toward 50% of all Ample K sales within four months after its launch.

Update: Stable supply chain amidst COVID-19 situation

With demand increasing in March and solid supply chain, Ample has a solid foundation to be able to support our customers well in this time of uncertainty:

As nearly all of our ingredients are US-Sourced with a US manufacturer, Ample is one of the fortunate few companies that has not had to reformulate the product away from internationally-sourced ingredients.

Ample is within the category of “essential products” deemed by the government. Thus, our production and distribution (including to Amazon) has not been curtailed in any way.

Our shipping partner is fully operational, with only minor (1 day) increases in shipping time during this time.

You may see that from time to time, due to extreme demand, certain products may become out of stock. We have been working around the clock with our partners to ensure we can provide the nutrition that people need. Your investment allows us to buy more ingredients in order to meet this demand.

Please see out investor update for more details.

Customers

Supportive community of loyal customers

To date, we’ve initially focused sales efforts on the most health-conscious niches with the highest needs. So far, these have been people with demanding careers and personal lives who also prioritize their fitness (often via CrossFit, yoga, or endurance training) and health. They are nutritionally conscious in general, often using Ample as an easy solution to stick to their keto or plant-based lifestyles.

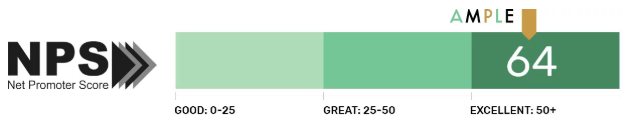

A Net Promoter Score measures the likelihood of customers recommending Ample to their family and friends. Ample has an NPS score of 64—with all scores of 50 and above rated Excellent.

Hundreds of positive reviews on Amazon, Facebook, and our website

Love from industry leaders

Business model

Profitable unit and customer economics

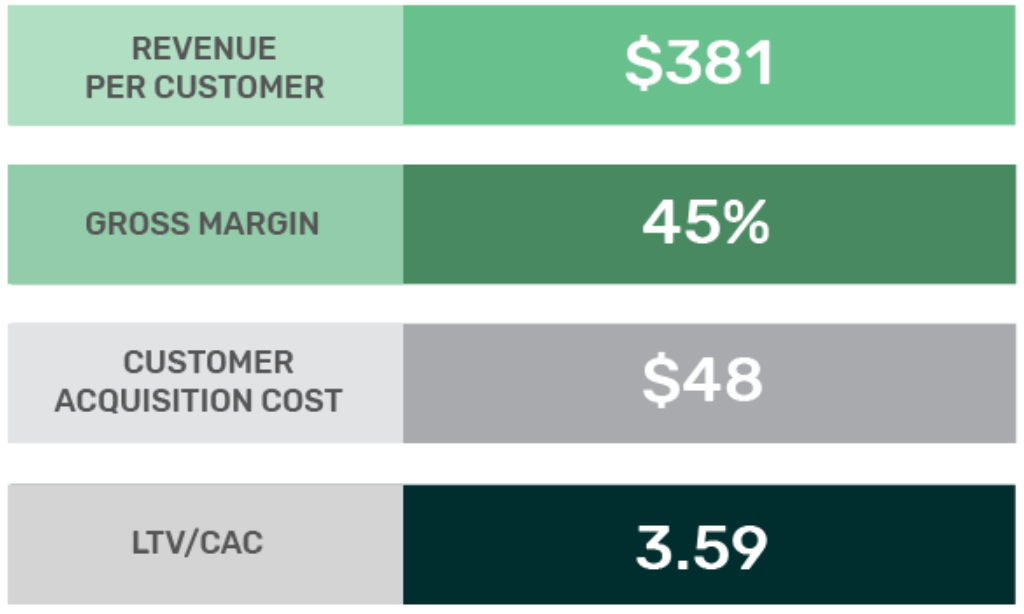

$381 Average Customer Revenue over 2 year period

Since so many of our customers integrate Ample into their daily routine, over 60% of our customers are loyal monthly subscribers that stick with us for years. This yields high revenue per customer, and the potential for community and word-of-mouth evangelism.

Margin increased 13 points from 32% to 45% in 2019

Improvements in supply chain efficiency and the introduction of a lower-priced, yet more profitable bulk canister offering has improved our margins significantly. As we scale, we expect to continue reducing costs, and soon pass cost savings onto our consumers.

3.59 Lifetime Value / Customer Acquisition Cost

With $381 revenue per customer and 45.5% margin, we make $173 gross profit per customer. Since our Republic campaign last year, we’ve been able to take our customer acquisition cost down to $48, meaning our LTV/CAC is a very healthy 3.59, which puts our business in an extremely positive place to scale profitably.

Focused go-to-market strategy

To date, we’ve initially focused sales efforts selling directly to our more health-educated audience via our website to establish community, customer relationships, and generate quick product feedback loops. Our biggest acquisition channels are paid social (Facebook, Instagram), paid search (Google Ads), distribution through health influencers.

Since last year, we’ve expanded into Amazon to bolster social proof for our expanding community, and to validate demand in preparation for broader health-conscious markets via retail and B2B distribution.

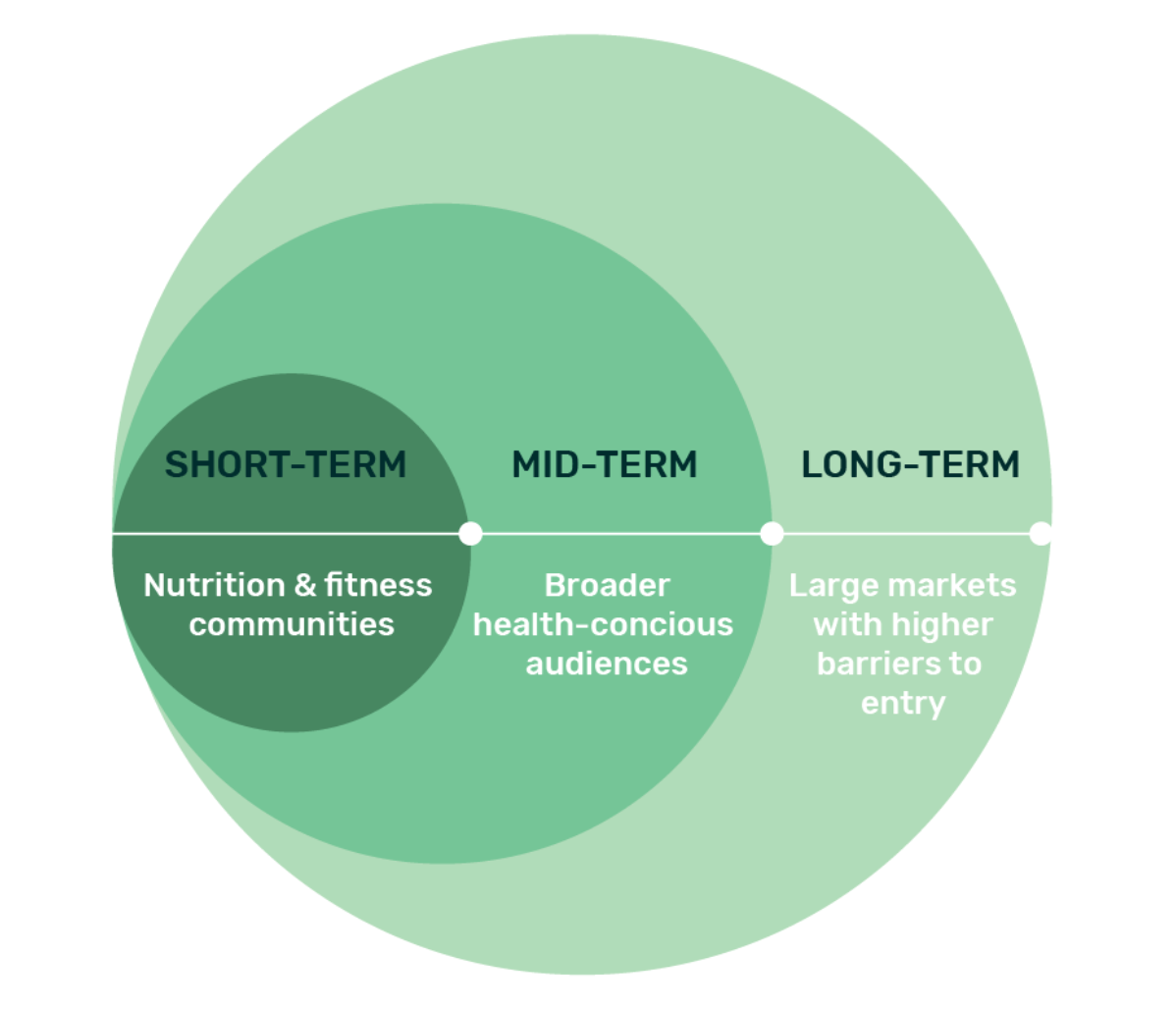

Short term: Our first step is continuing to tap into large and growing nutrition and fitness communities like Keto and Plant-based. We will release other flavors with validated market demand such as coffee. We will continue optimizing our paid channels while exploring other organic growth channels like community and educational content.

Mid-term: While continuing to maintain high ingredient sourcing standards, we’ll create more flavor options and an even more convenient ready-to-drink (RTD) form factor with liquid instead of powder in a bottle, which will also enable an “omni-channel” distribution model including grocery stores and corporate offices.

Long-term: We will increase accessibility to more demographics by reducing price through economies of scale, and increasing distribution to corporate wellness, military, and hospital markets that require higher barriers of entry. We’ll expand internationally, and explore creating products beyond the meal replacement market.

Market

$18B market ripe for disruption

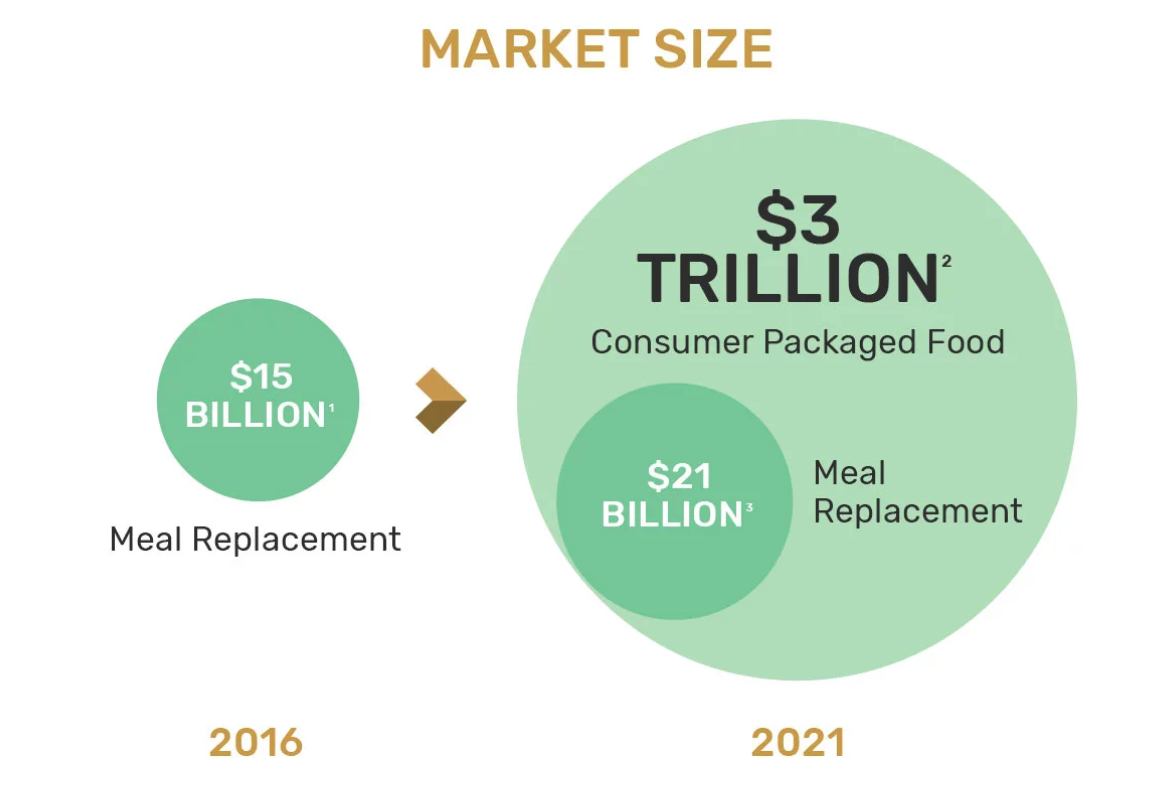

The size of Ample’s market opportunity is bigger than ever, meaning that if we are successful, we could become one of the world's most valuable food brands. We’re focusing initially on the $18 billion meal replacement market—then expanding into the $3 trillion CPG food category.

Immediate opportunity: meal replacement market

Despite rapid growth in the $18 billion meal replacement market, major players like Soylent, Ensure, Muscle Milk, and Boost are out of step with growing consumer demands for healthier products and better ingredient quality.

2 in 5 U.S. consumers agree “no artificial ingredients” is important when shopping for food and drink, but large incumbents struggle meeting needs for taste and trustworthiness.

Interest in health is skyrocketing, with consumers increasingly going on plant-based and keto diets.

As a product-focused focused company committed to delivering the highest quality products, Ample is ideally positioned to keep pace with growing consumer demands for better nutrition—not just taste and convenience.

Larger Opportunity: Convenience Packaged Food & Beverage Market

As we scale, we plan to expand beyond the meal replacement category to the overall $3 trillion convenience packaged food market, which is ripe for innovation.

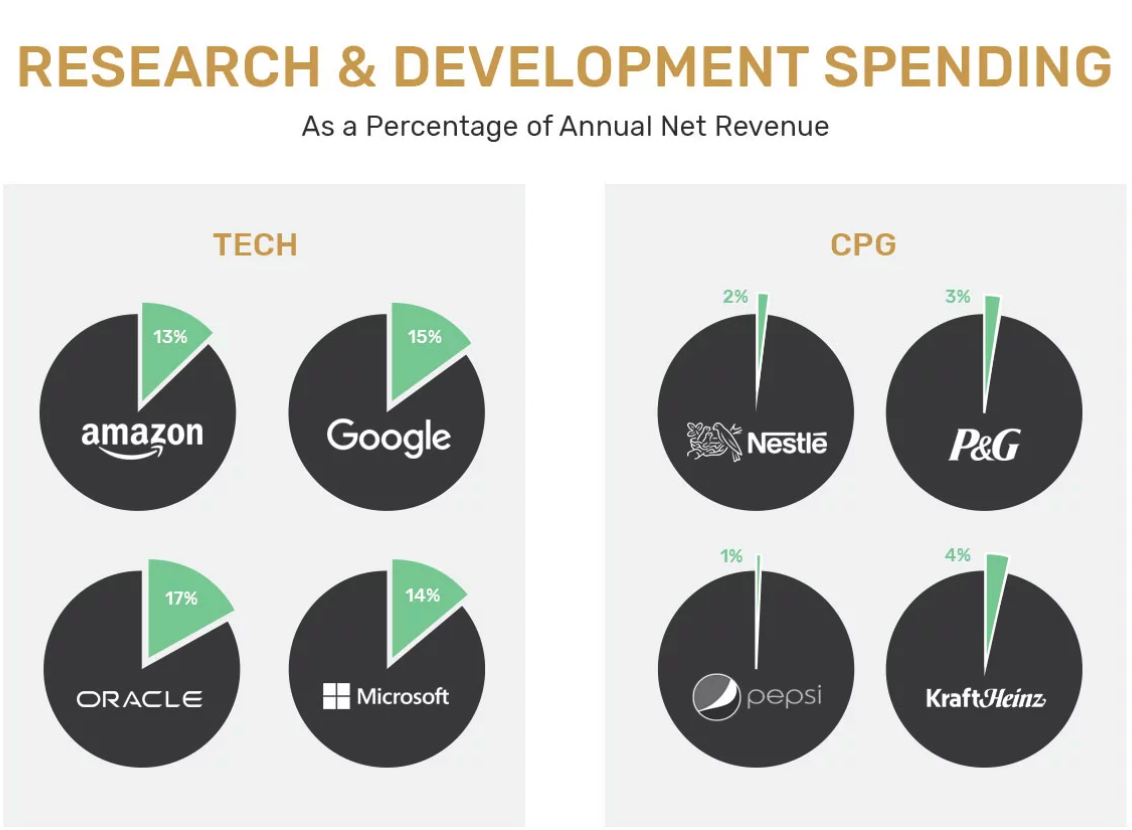

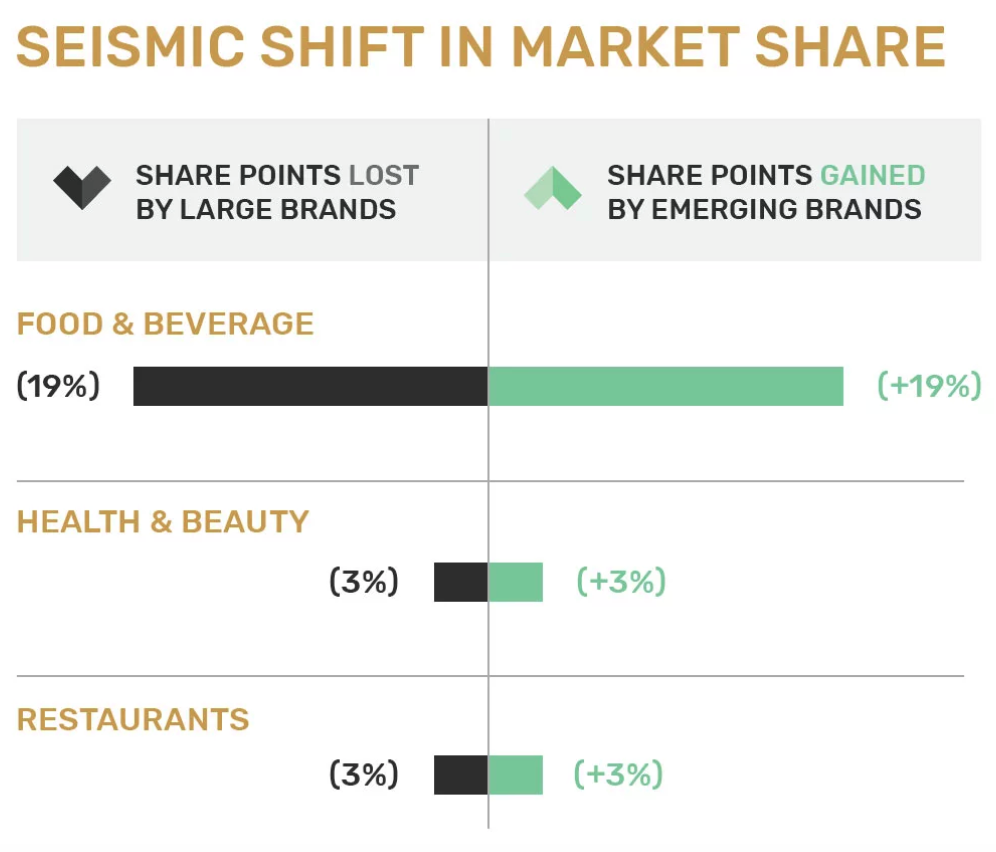

Large CPG (consumer packaged good) brands spend almost nothing on new product innovation, compared to other industries like tech. Instead, they funnel their budgets into marketing convenient food options that are tasty and inexpensive, but not necessarily good for you.

As they develop new solutions that are better aligned with changing consumer demands, emerging food companies like Ample are already stealing market share from the larger companies.

Shaping the future of the food industry

By establishing our reputation as a trustworthy, product-centric company focused on improving nutrition at scale, Ample will be positioned to expand into other products that align with changing consumer habits for healthier food trends.

In doing so, we commit to improving access to proper nutrition and reshape the food industry for the better.

Competition

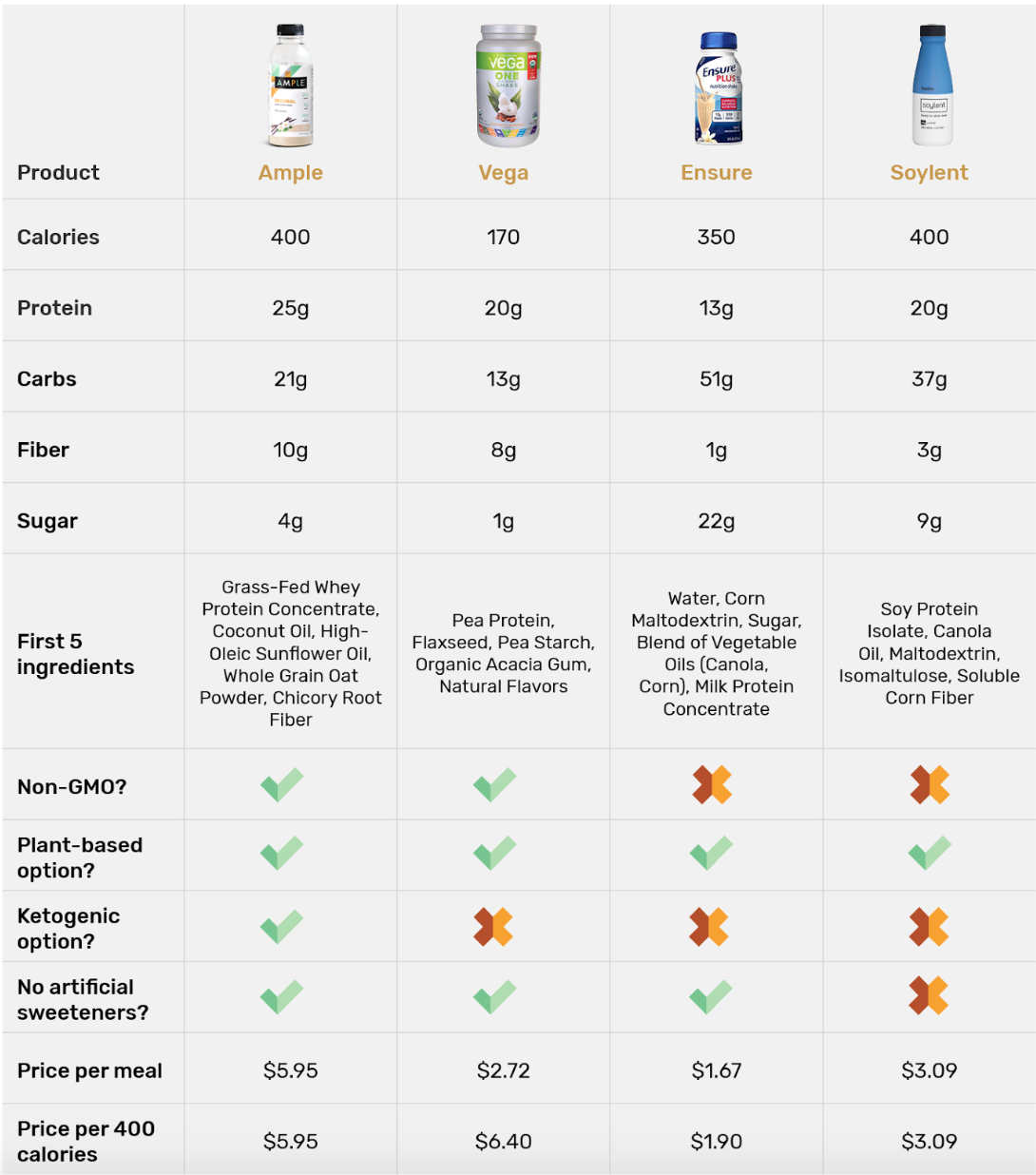

Industry-leading nutrition, taste, and convenience

As one of the largest industries in the world, the massive size of the consumer food market allows for multiple winners in each category, with meal replacements being no different. There is substantial opportunity to carve into this large and growing market for healthy, great-tasting products.

Three major groups of meal replacement competitors:

Slimfast and Ensure paved the way for this category more than 40 years ago, and are still going strong, distributed through Walgreens, CVS, and convenience stores. Targeting an older demographic and the hospital market, these low-cost products haven’t evolved much over the years, and their low ingredient quality shows this.

Soylent, Huel, and their imitators modernized the Slimfast concept to create low-cost complete meals, targeting the millennial market for the cheapest price per calorie. While this has been a successful strategy, their flavor, texture, and ingredient quality has suffered. For those more health-educated consumers looking for premium fuel for their lives, these options don’t cut it.

Vega, Orgain, and OWYN have created products with high ingredient quality, though tend to be low-calorie products containing little more than protein, greens, and vitamins, lacking the healthy fats and calories necessary to sustain you. For customers actually wanting to feel full or who are on a low carb lifestyle, these options don’t suffice.

Here's how we stack up:

How our flavor stacks up:

Last year, a pilot blind taste test was conducted comparing Ample Original and Ample V with three of our competitors, Huel, Soylent, and OWYN. Each product was graded its flavor, aroma, aftertaste, sweetness, and mouthfeel on a scale from 1 (“dislike extremely”) to 9 (“like extremely”).

Ample Original came in first (“like very much”) and Ample V in second (“like moderately”), with competitor scores ranging from “dislike slightly” to “like slightly”.

Ample has learned from the rest and has a convenient product with a balanced macronutrient profile full of healthy fats, proteins, carbs, fiber, and probiotics that is both filling and great-tasting. We focus on a health-conscious demographic that wants the best for their lives, valuing both their health and their time.

Vision and strategy

Join us in our mission to make optimal nutrition simple

We’ve spent the last 3 years creating the most nutritious, great-tasting, and convenient products on the market, as demonstrated by our strong base of loyal, high-value customers. Since our last fundraise on Republic, we’ve become a financially sustainable, profitable business.

Long-term, we intend to shape massive change in the food industry—forcing companies to level up in their nutrition, ingredient quality, environmental impact, and transparency. Through economies of scale, we can also reduce the cost of healthy food and make convenient, optimal nutrition accessible to all.

By investing in Ample today, you can help us become a major player in the global meal replacement market and later, expand into the larger global CPG market. Your investment will accelerate our growth—helping us expand into retail stores and new distribution channels, while bringing more nutritious, great-tasting, fast meal options to market.

While today's modern world doesn't make it easy to be healthy, Ample does. And with your support, we can help people everywhere eat, work, and live better—now and for years to come.

Funding

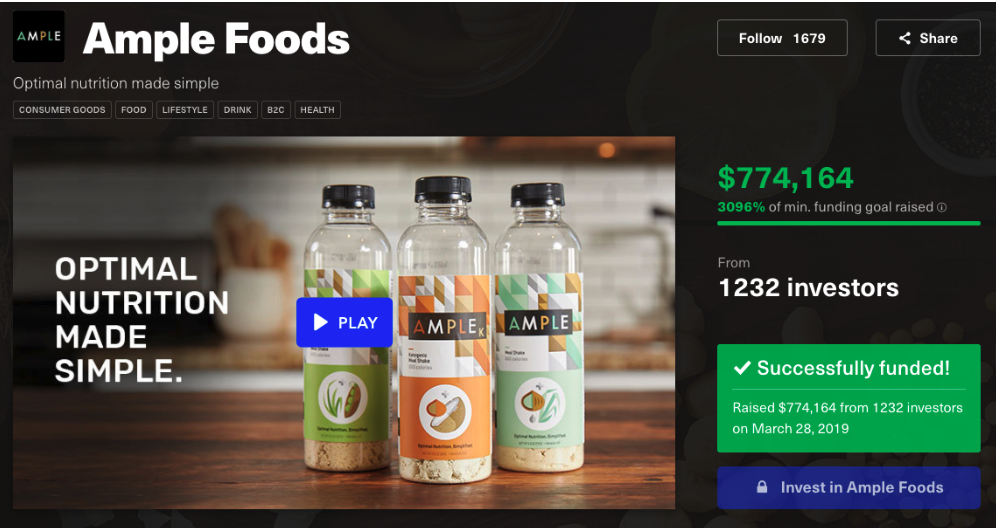

$5M raised from strong investor community

$774k from 1232 Republic investors just like you

As of last March, Ample was the fastest start of any crowdfunding campaign on Republic, thanks to the support of 1232 investors like you. We’ve used their money wisely to become a profitable, sustainable business with substantial opportunity moving forward.

Join these investors now to take part in our mission to make convenient, great-tasting, optimal nutrition to the world.

Founders

Connor’s passion for nutrition and health led him to complete a biology degree from St. Olaf College—and land deep in the CrossFit movement after graduation. Starting with co-founding a CrossFit gym after graduation, Connor found it immensely gratifying to help others improve their health through exercise and diet. Later, when he joined the medical sales team at Johnson & Johnson in 2013, Connor found himself in operating rooms, witnessing thousands of patients with chronic diseases that could have been prevented by making healthier lifestyle choices. That's when he knew he needed to shift his efforts to the preventive side of health.

After moving to San Francisco in 2014, Connor began this quest by forming a health startup—a physical therapy patient engagement platform. However, while living in a co-op community of entrepreneurs, his sights shifted to Ample when a friend asked him for a not-so-simple request: to make it easy for him to eat well, while working long startup hours. Connor worked tirelessly to make him a drinkable meal that aligned with the emerging nutrition research he voraciously followed.

That's when Ample was born—a company committed to making it simple for people everywhere to have access to an easy, healthy meal.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...