Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

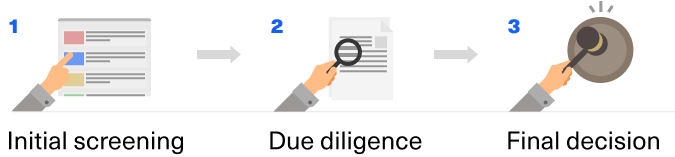

How we select startups

Less than 5% acceptance rate: we carefully select startups from thousands of applications.

“A much higher screening process.”— Jason Calacanis about Republic

The selection and review process:

Initial screening

We first look for strong positive signals using the FPTM model:

Founders — Product — Traction — Mission

Founders

Does this founder have the skills and vision to succeed? We look for dedication, diversity, location, charisma, experience, vision, track record, network, competence, long-term partner, and ability to execute, among other things.

Product

Is the idea (the problem and solution) compelling? What does the execution, quality, attention to detail, and technology look like?

Traction

Has there been measurable progress, growth, and social proof? Is the company backed by other notable investors? Did they manage to get good press?

Mission

How is this startup going to make an impact on the world?

Due diligence

After we determine that a startup is a good fit, we kick-off the formal due diligence process. We review each startup’s pitch deck, conduct screening calls, and complete independent research to better understand the startup’s business and, if necessary, tap into our networks to help us evaluate the following factors:

| Business model |

Business model

How does the startup make or intend to make money? How much can it make?

|

| Social impact |

Social impact

How big is their impact and how will they fulfill their mission?

|

| Market |

Market

How large or disruptive can this business be?

What advantages do they have over their competitors?

|

| Technology |

Technology

How is technology used to solve the problem?

Is it unique or difficult to replicate?

|

| Team |

Team

Beyond the founders, does the team have the right people in the

appropriate roles—including experienced advisors?

|

| Fact checking |

Fact checking

Is the information presented in the pitch true?

We verify key facts, contracts, and investments.

|

| Terms |

Terms

Is the valuation cap and other terms appropriate given the startup’s

current stage and traction?

|

| Runway |

Runway

Does the startup have enough runway to survive without the Republic campaign?

Are the funding goals reasonable for the startup’s runway?

|

| Eligibility |

Eligibility

Does the startup meet the legal criteria for a regulated crowdfunding offering?

We do a thorough financial and legal review, and run background checks on founders

and officers. All companies must be U.S.-based.

|

See also: how we select and screen crypto projects.

Final decision

After completing our due diligence, we will decide whether to offer the company the opportunity to raise on Republic.

Once the proper documentation is prepared, the startup will go live on Republic, where we will continue to monitor the campaign and help educate and inform investors.

How do we spot a good opportunity?

Team expertise

We have deep knowledge and roots in the venture world and the startup ecosystem.

Republic spun out of AngelList—the world’s #1 platform for accredited private company

investing—and has since attracted the top talent from companies like NASA, Merrill Lynch,

Facebook, Google, Blackrock, CoinList, Goldman Sachs, and others.

Our team’s educational background features some of the world’s best schools, including Harvard Business School, Stanford, Duke, Berkeley, Oxford and Cambridge, and others.

Trusted referrals

Much of our deal flow comes recommended by our vast

network of partners:

venture funds, accelerators, incubators, advisors, angel investors and founders networks.

Republic is an investor in each startup on our platform—we stand behind our companies and consider them partners. We rep them post-fundraise and help with follow-on rounds.

Read more in our Blog about how to find investors for your business.

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC