Seattle-based startup Nori is hoping to deliver what Al Gore, the Paris climate accord and others have not: a market-driv...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Nori

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Nori is a marketplace for reversing climate change

Nori is a blockchain-based marketplace to remove carbon dioxide from the atmosphere. The NORI token works as a medium of exchange for Carbon Removal Certificates (CRCs).

Deal highlights

- Most carbon markets and efforts to fight climate change are set on reducing CO2 pollution; Nori is different and wants to completely reverse climate change by removing CO2 from the atmosphere

- Economists and policymakers agree: we need a price on carbon. The NORI token delivers that for the world

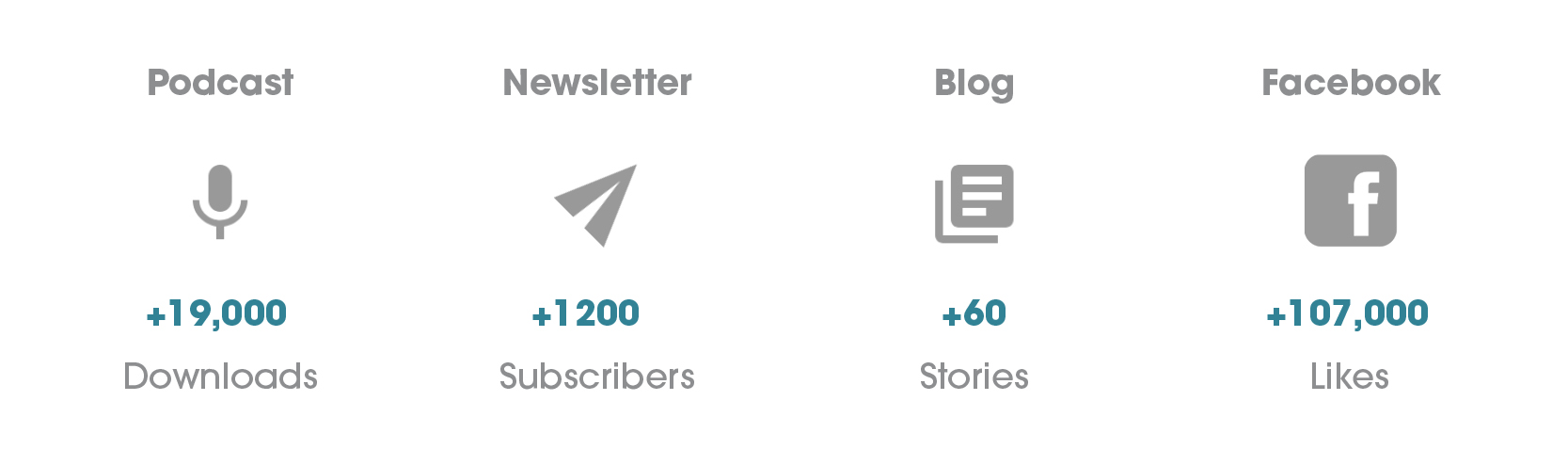

- Featured in Fast Company, GreenBiz, GeekWire, New Food Economy, CleanTechnica, Virgin Unite, and Sea Change Radio

- Nori's Reversing Climate Change podcast has over 35 episodes and is the leading podcast on carbon removal

- Founders and advisors have more combined experience in carbon removal than nearly any other team on earth, having developed cutting-edge technologies and founded key initiatives in the space

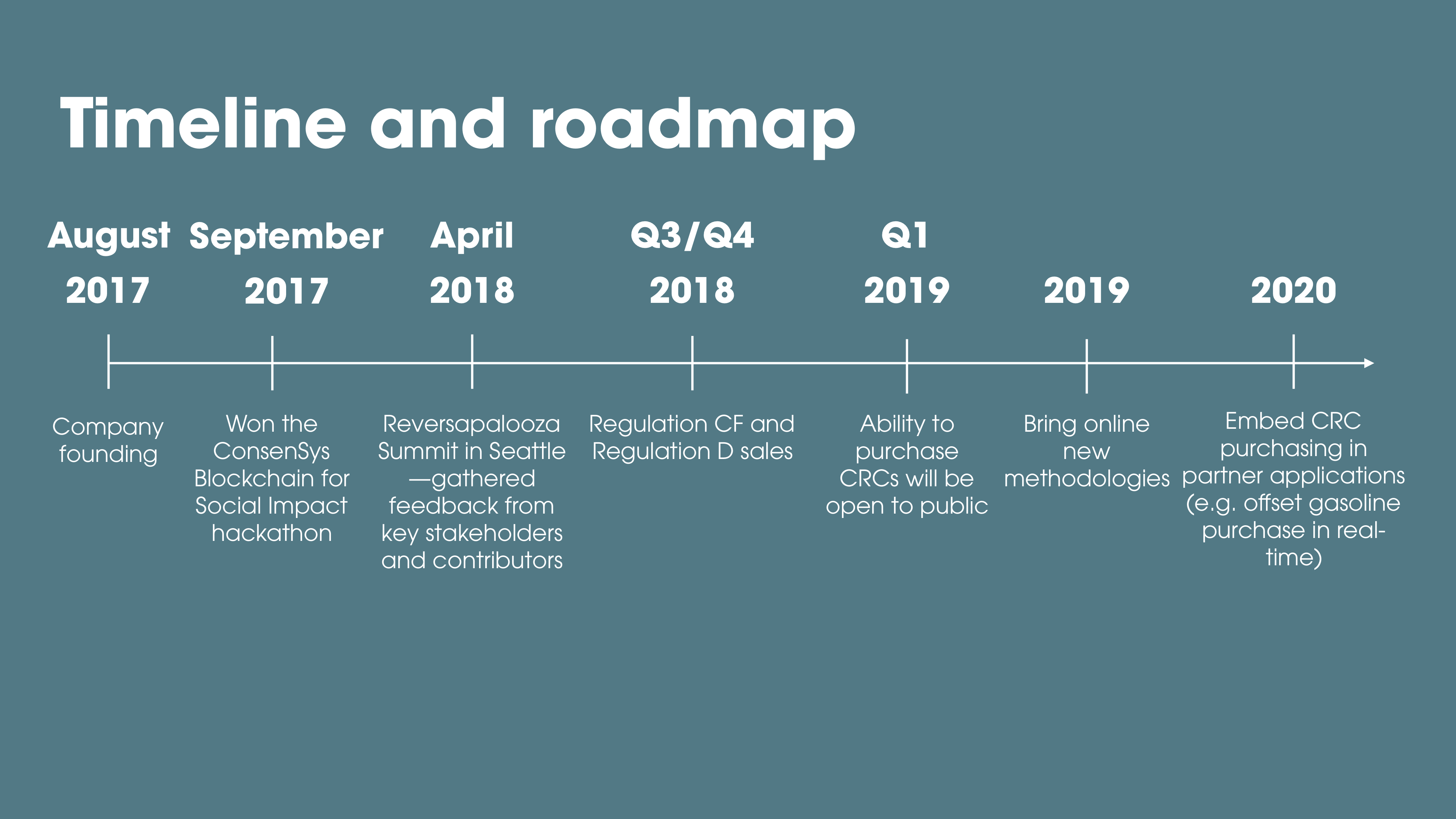

The Nori marketplace is being built right now and we project to launch both the market and tokens for real carbon removal transactions in Q1 of 2019. This offering is for Token DPAs, a convertible security that can be converted to NORI tokens if certain terms and conditions are met.

Nori puts the power to reverse climate change in your hands

We are all affected by climate change. And most people feel like we’ve run out of options for dealing with it. Many have tried lobbying their government for action, but the response has been slow and insufficient.

Nori is putting the power to reverse climate change back into your hands. Our marketplace incentivizes people to remove carbon dioxide from the atmosphere. By buying our tokens, you can use them to pay others for removing CO2.

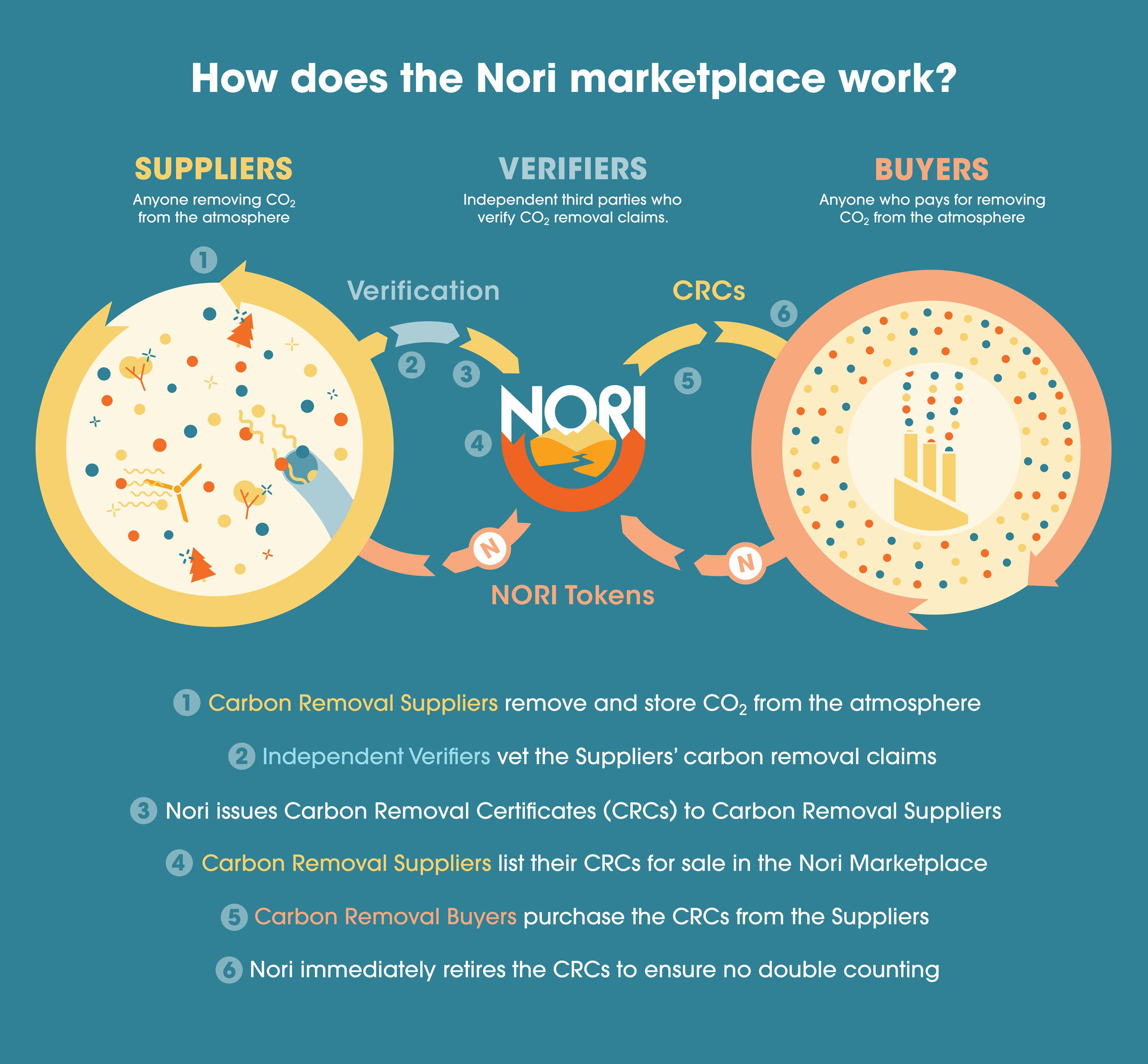

How we enable carbon removal

One NORI token can be used to buy one Carbon Removal Certificate (CRC), representing one tonne of CO2 removed. The person who removed the CO2 gets paid with that NORI token and can trade that for cash or any other cryptocurrency. By creating a marketplace where people can easily pay for carbon dioxide removal, Nori will incentivize more people to remove carbon dioxide and ultimately reverse climate change.

The Nori marketplace participants

Suppliers of CRCs get paid in NORI tokens for how much CO2 they’ve removed. It’s a way to monetize activities they might already be doing or inspire new entrepreneurs and businesses to invest in carbon removal.

Verifiers of CRCs vet carbon removal claims made by suppliers, and in turn get new opportunities for expanding their businesses as they innovate more accurate methods for verifying CO2 has been removed.

Buyers of CRCs get verified certificates that prove carbon dioxide has been removed. They can use these certificates for meeting carbon reduction obligations and for corporate social responsibility reports.

The NORI token

Per leading economists and policymakers, it’s clear that we need a price on carbon. The NORI token delivers that for the world. The price of NORI should be similar to how the Brent Crude Oil reference price functions for oil prices. It’s one single price that reflects true market demand for carbon dioxide.

One NORI token will always pay for removing one tonne of CO2 from the atmosphere. The price of the NORI will change over time as the demand for removing CO2 changes.

As the price of NORI increases, so too does the incentive for people to remove carbon dioxide. We envision an entirely new industry of businesses, jobs, products, and overall value being created to remove CO2 from the atmosphere. The more the NORI token is worth, the more people will take action to reverse climate change.

How carbon removal works

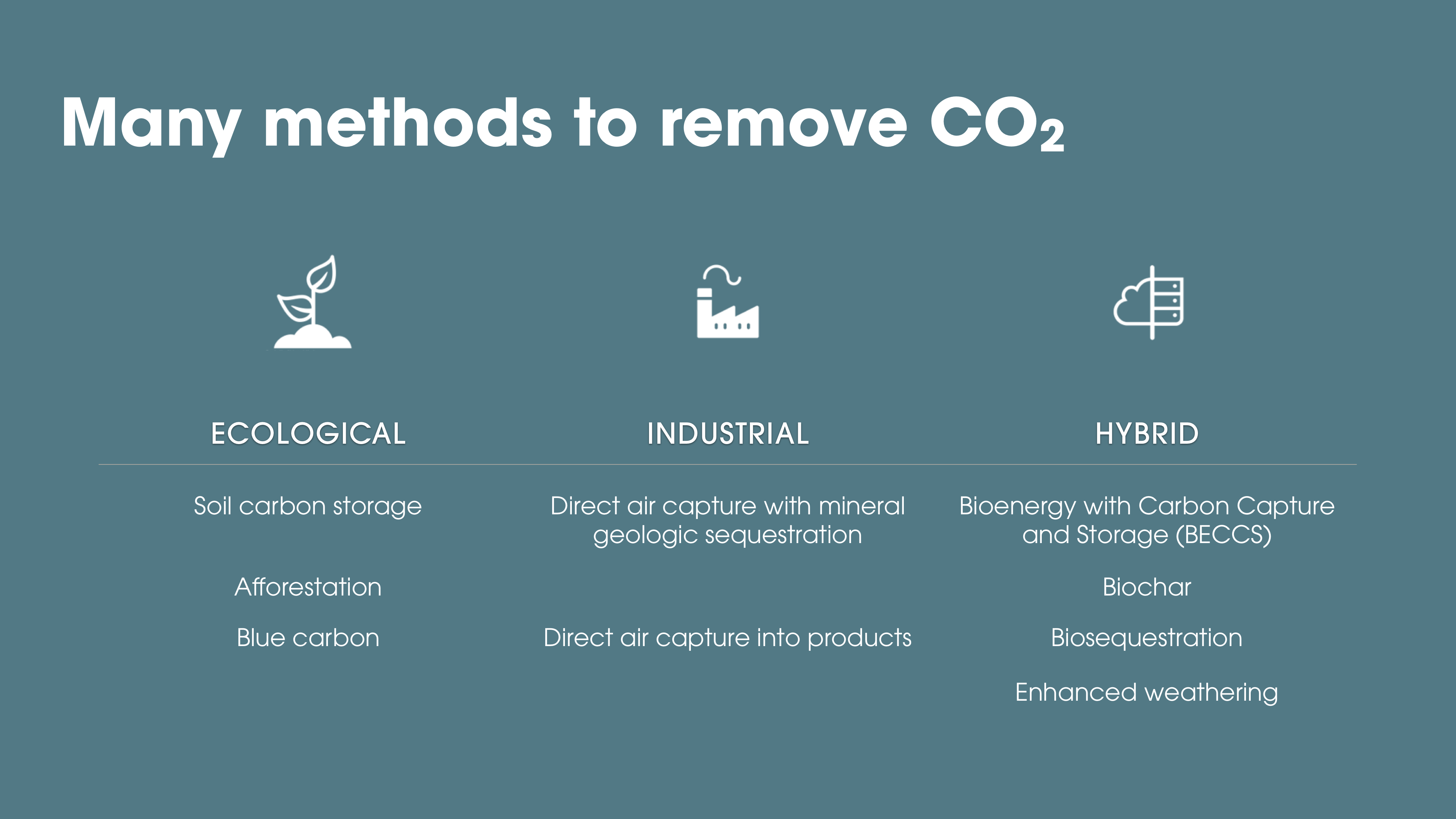

There are already many different methods available that can remove carbon dioxide from the atmosphere and safely store it so that it no longer impacts global warming. We group them into three broad categories: ecological, industrial, and hybrid.

Ecological

Farmers can change their agricultural practices to store more carbon in soils. Forest managers can grow trees that sequester the CO2. Kelp and seaweed can be grown in waters all around the world and then dropped to the bottom of the ocean.

Industrial

Technology like direct air capture can be used to create artificial trees that absorb CO2 from the air. That captured CO2 can be pumped underground where it will turn into rock, or it can be used to manufacture products like plastics, tennis shoes, and carbon fiber.

Hybrid

Hybrid approaches combine both ecological and industrial methods. Crops can be grown that are burned in power plants for energy, and their emissions are captured for storage in underground reservoirs. Minerals like olivine can be forced to absorb CO2 through a process called enhanced weathering. Construction materials like carbon-negative cement and sustainably-harvested timber can be used for buildings.

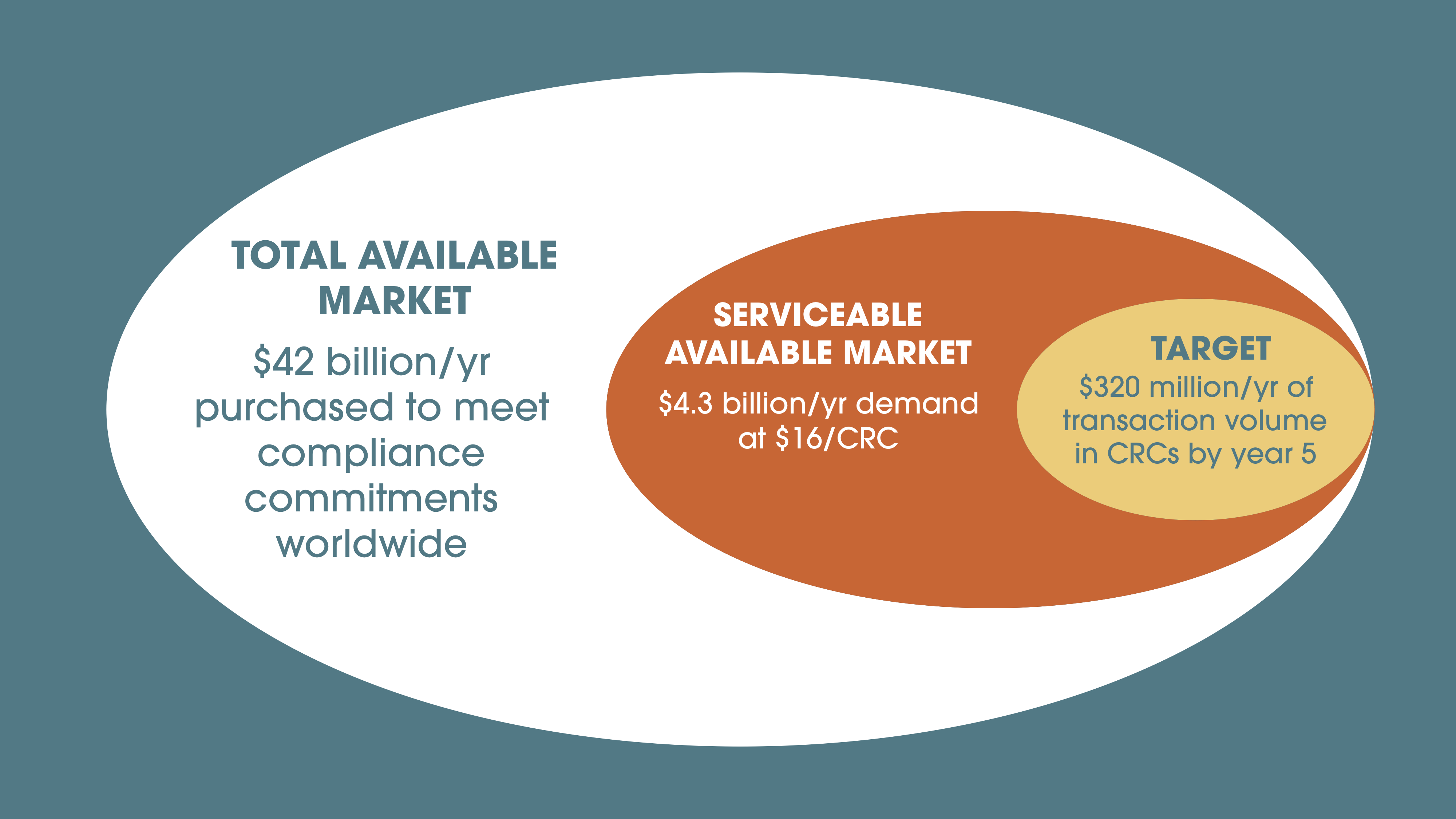

Market opportunity

Nori’s first carbon removal methodology

While Nori plans to enable a suite of carbon removal technologies in its marketplace, we will initially focus on carbon removal through soils. Agricultural practices have contributed to over one-third of the CO2 emitted into the atmosphere since the Industrial Revolution. By changing to practices of no-till, cover-cropping, and crop rotations, farmers can not only store more CO2 in their soil, but also better retain water and grow crops with higher yields. Soil carbon removal comes with an incredible range of benefits to the farmer, and so an incentive to participate in the Nori marketplace already exists.

Traction

Shortly after forming the company, we entered and won the ConsenSys Blockchain for Social Impact Hackathon in the Energy & Environment category.

In April 2018, Nori hosted the first-ever Reversapalooza conference in Seattle, WA. We brought together over 100 of the world’s leading experts in carbon removal, regenerative agriculture, and carbon markets to discuss the Nori market design. Footage of the entire conference is available on the Nori YouTube page.

Since Reversapalooza, we’ve been gathering feedback from market participants on our methodology designs in a series of webinars found here.

Our podcast, Reversing Climate Change, is the only podcast dedicated exclusively to a discussion around carbon removal. We’ve had over 19,000 downloads since we launched it in December 2017.

Read more:

Nori in the media

Fast Company: This “carbon removal marketplace” will make buying offsets easier

GeekWire: Seattle-based startup Nori is hoping to deliver what Al Gore, the Paris climate accord and others have not: a market-driven solution to not only curb greenhouse gas emissions, but actually remove planet-warming carbon from the atmosphere.

The New Food Economy: With a blockchain-based accounting platform, Nori can prove to buyers that the credits they purchase are retired and not resold to other companies.

Timeline

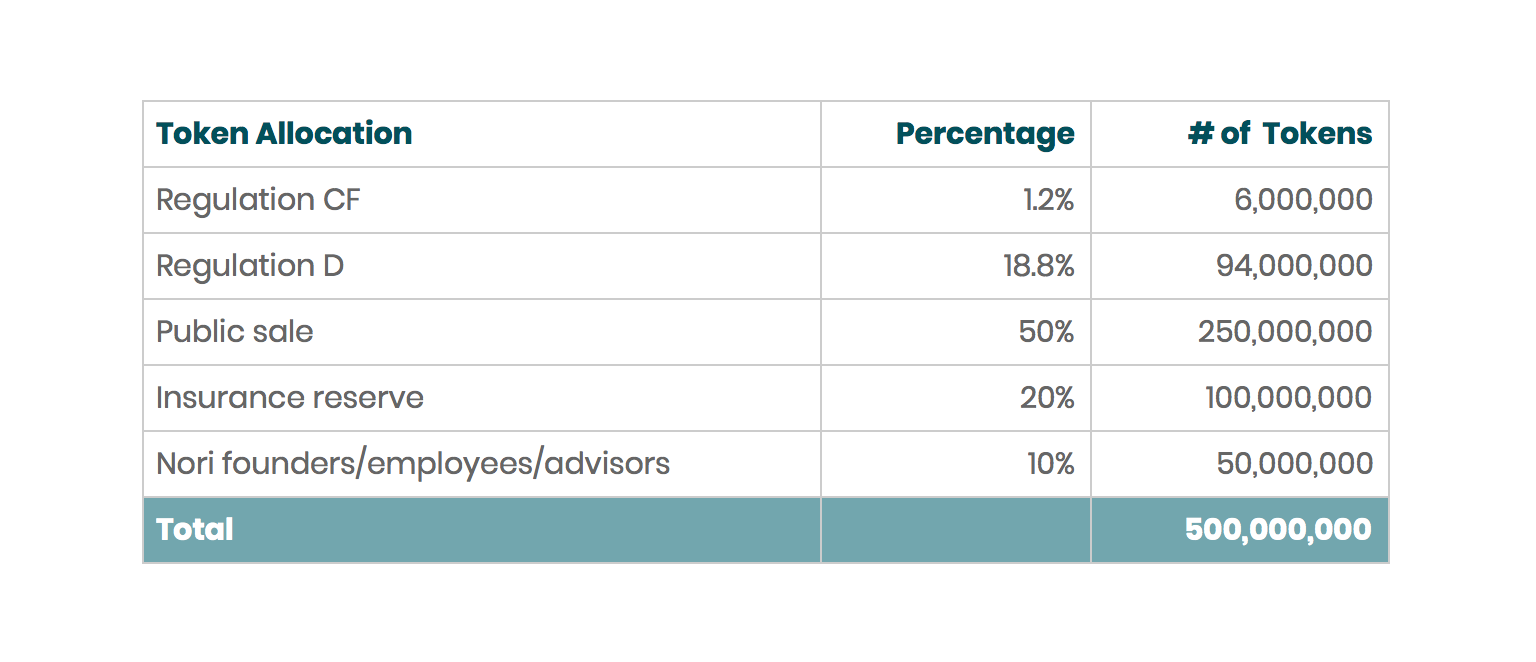

Token allocation

We are creating a total of 500 million tokens. Six million are offered for sale in this crowdfunding campaign. Ninety-four million will be sold to accredited investors in a Regulation D securities sale.

Two hundred and fifty million tokens will be sold after the Nori marketplace has launched. One hundred million tokens will be held as an insurance reserve (to pay for invalid CRCs in order to make the buyers whole), and 50 million are reserved for the Nori team. These tokens for the Nori team will be distributed over a four-year vesting schedule.

Nori team

Nori founders, from left to right: Alexsandra Guerra, Christophe Jospe, Ross Kenyon, Jaycen Horton, Aldyen Donnelly, Paul Gambill, Paul Carduner

We come from a variety of backgrounds, but are all united in purpose and mission to reverse climate change:

Aldyen Donnelly has been an expert on carbon markets and carbon pricing for over 25 years, and she wrote the very first soil carbon contract for the Iowa Farm Bureau at the turn of the century.

Paul Carduner sold a startup to Facebook and went on to found and lead the engineering teams for Facebook’s photos and videos products.

Michael Leggett worked at Google and Facebook and led the design teams for Gmail, Google Inbox, Google Finance, and Facebook Messenger.

Christophe Jospe worked as the Chief Strategist at the ASU Center for Negative Carbon Emissions.

Paul Gambill founded the first-ever networking group for carbon removal and is an experienced software product manager.

Alexsandra Guerra is an environmental engineer who was inspired at the age of 15 by Nori advisor Klaus Lackner to build machines that could remove carbon dioxide.

Ross Kenyon is an experienced blockchain community expert and has worked with Tezos, Sweetbridge, ZenCash, Indiegogo, and Blue Frontiers.

Jaycen Horton is co-organizer of the largest blockchain meetup in Arizona, and previously worked as a lead software engineer for Dell and Wells Fargo.

Advisors

Our advisors are industry leaders in carbon removal, clean energy, and the technology industry at large.

Klaus Lackner, PhD

Dr. Klaus Lackner pioneered the concept of direct air capture more than 20 years ago. He is currently the Director of the Centre for Negative Carbon Emissions at Arizona State University.

Ramez Naam

Ramez Naam is a futurist, sci-fi author, and the Co-Chair for Energy and Environment at Singularity University at NASA Ames. His book, The Infinite Resource, was an early inspiration for Nori co-founder Paul Gambill.

David Addison

David Addison is the manager of the Virgin Earth Challenge, Sir Richard Branson’s $25M innovation prize for scalable and sustainable ways of removing carbon from the atmosphere.

Bob Beth![]()

Bob Beth has founded several software companies, and is currently a Special Advisor to the World Business Academy for their Clean Energy Moonshot in California.

Join Nori in the mission to reverse climate change!

Nori is building a marketplace so that anyone in the world can make it their mission to reverse climate change.

Use NORI tokens to offset your carbon footprint, invest in a new commodity for carbon removal, and spark the growth of a new industry that can restore the balance of carbon dioxide in the atmosphere. The more people buy and use NORI tokens, the more we collectively incentivise farmers, entrepreneurs, and businesses to remove carbon dioxide across the globe.

All contents of this deal page are qualified in their entirety by the latest Form C found here:

Forward Looking Statements: These materials contain forward‑looking statements concerning trends or anticipated results which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward‑looking statements are not guarantees of the Company’s performance and are subject to risks and uncertainties related to Company’s operations and business plan. These risks and uncertainties include, but are not limited to: the timely availability of financing on acceptable terms, the Company’s ability to develop and operate its business and network in a timely and efficient manner, the availability of future purchasers and sellers of carbon reduction credits, and other future events and conditions. These projections are based on a number of assumptions and estimates made by management and Company’s actual results or activities, or actual events or conditions, could differ materially from those projected in these materials.

Deal terms

$1.07M

Nori must achieve its minimum goal of $50K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Token DPA (Late Stage with Escrow)

If the campaign is successful, you’ll receive a Token DPA for your investment.

The DPA is not equity or a token itself, but a loan that payable in tokens in

the future, with interest.

Learn more

3 years

The amount of time Nori has to pay out your investment in tokens.

If the DPA isn't repaid with tokens after that time, it will be payable in cash

with interest.

Learn more

10%

The interest amount that will accumulate on your investment

if it’s paid back to you in cash.

Learn more

15.75%

The interest amount that will accumulate on

your investment if it’s paid back to you in tokens.

Learn more

50% of net debt amount before 2 years

How much you can get back of your investment if you choose to cancel

the Token DPA before it’s paid back.

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

About Nori

Nori Team

Everyone helping build Nori, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC