Holly's students have participated in several PenPal Schools VR projects, including a VR Field Trip to Pakistan. PenPal S...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

PenPal Schools

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Connecting over 320,000 students from over 7,000 schools in 150 countries

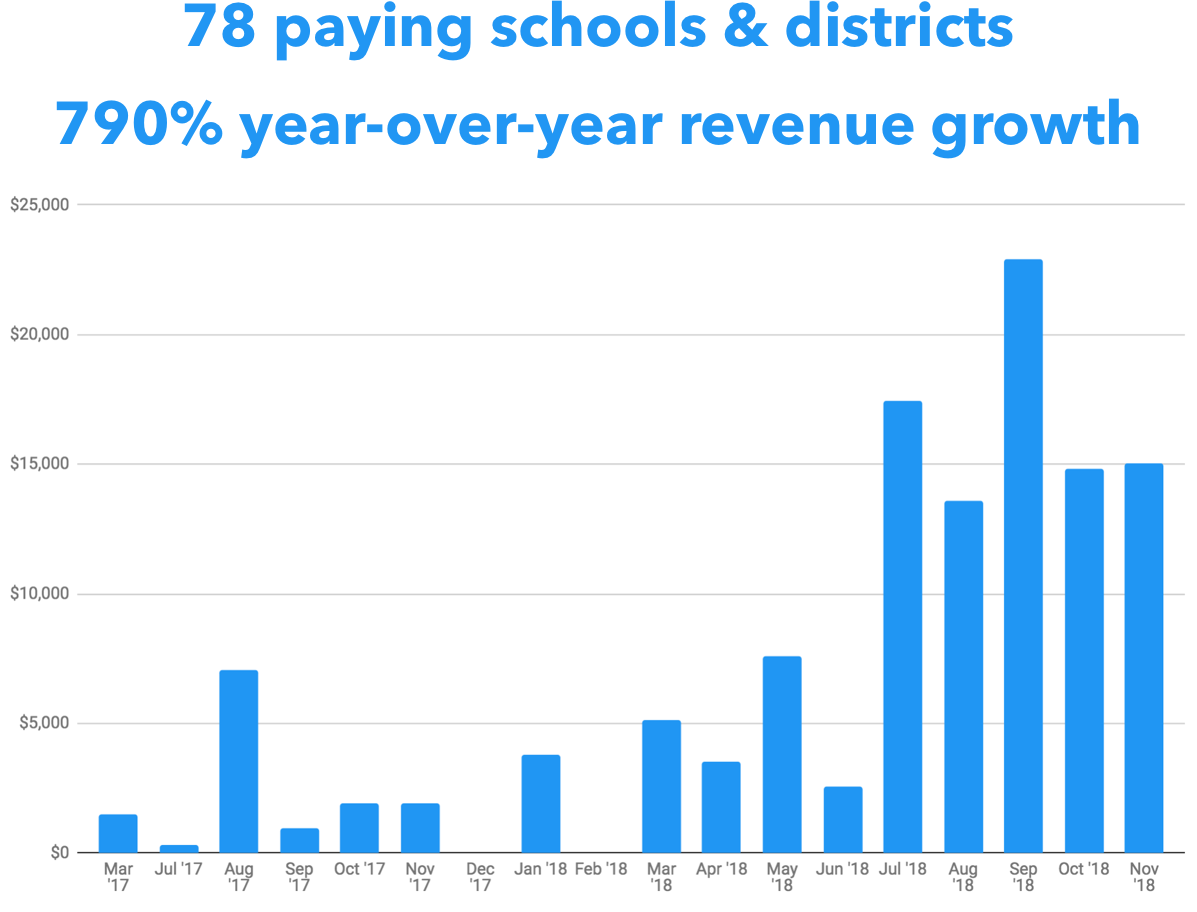

- 78 paying schools and districts (average deal size = $1,770 / year)

- Named Best Education Technology of 2017 by Common Sense Education

- Recognized by President Obama as a leading social enterprise

- Led by an experienced entrepreneur whose previous company generates $5M annual revenue

- Partnered with leading publishers including Time Inc, Via Afrika, and Films BYkids

- $1.25M raised to date from Stanford, Floodgate, Techstars, Capital Factory, Dreamit, Honeycomb Portfolio and more

“Why do we have to learn this?” It’s the question that haunts every teacher. When schoolwork doesn’t seem relevant, students quickly lose interest and stop learning. And with information just a Google search away, memorizing facts for tests seems more pointless than ever.

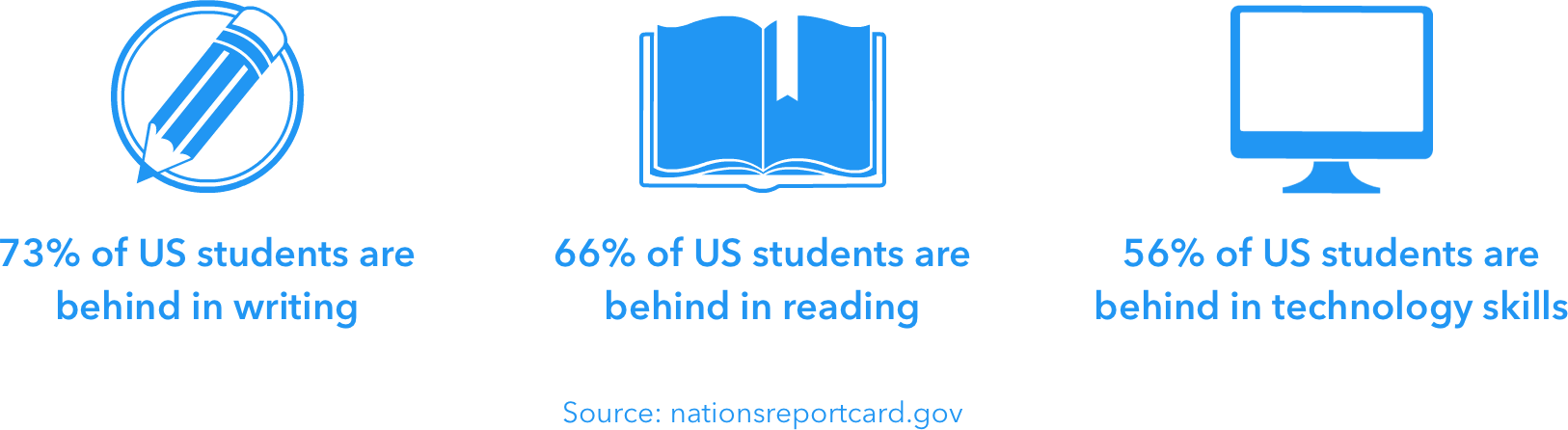

This lack of student motivation has led to a crisis in our education system, with students failing to meet grade level targets across all ages and skills.

Innovative schools are starting to change

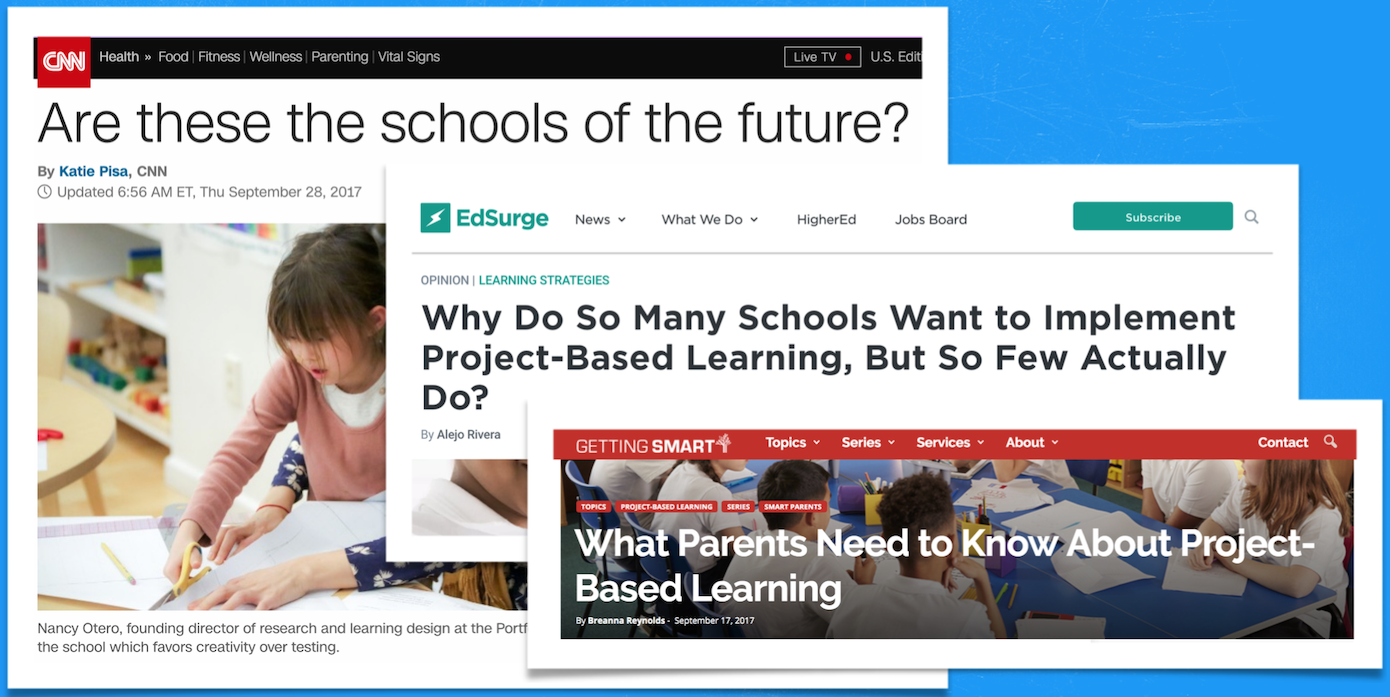

Fortunately, many schools across the US and around the world have recognized that a system based on memorization and testing is not effective. Innovative teachers are leading a movement towards project-based learning, where students demonstrate their learning not by passing a test, but by creating original work. When done well, project-based learning not only motivates students to learn the required content and skills, it also helps them to develop creativity, communication and collaboration skills.

With over 320,000 participating students in more than 150 countries, PenPal Schools is leading the project-based learning revolution.

Explore a map of participating schools in 150 countries

Students on PenPal Schools don’t just write to each other - they collaborate globally to design robots, create films, explore careers, and find local solutions to global problems. Sound like fun? It is!

Meet more teachers and PenPals from around the world

Students on PenPal Schools are so engaged and motivated in their learning that PenPal Schools has earned high-profile press and won numerous prestigious awards, including Best Edtech of the Year by Common Sense Education (a big deal). PenPal Schools was also recognized by President Obama (a bigger deal) as an outstanding social enterprise - an organization that uses a for-profit business model to create positive change.

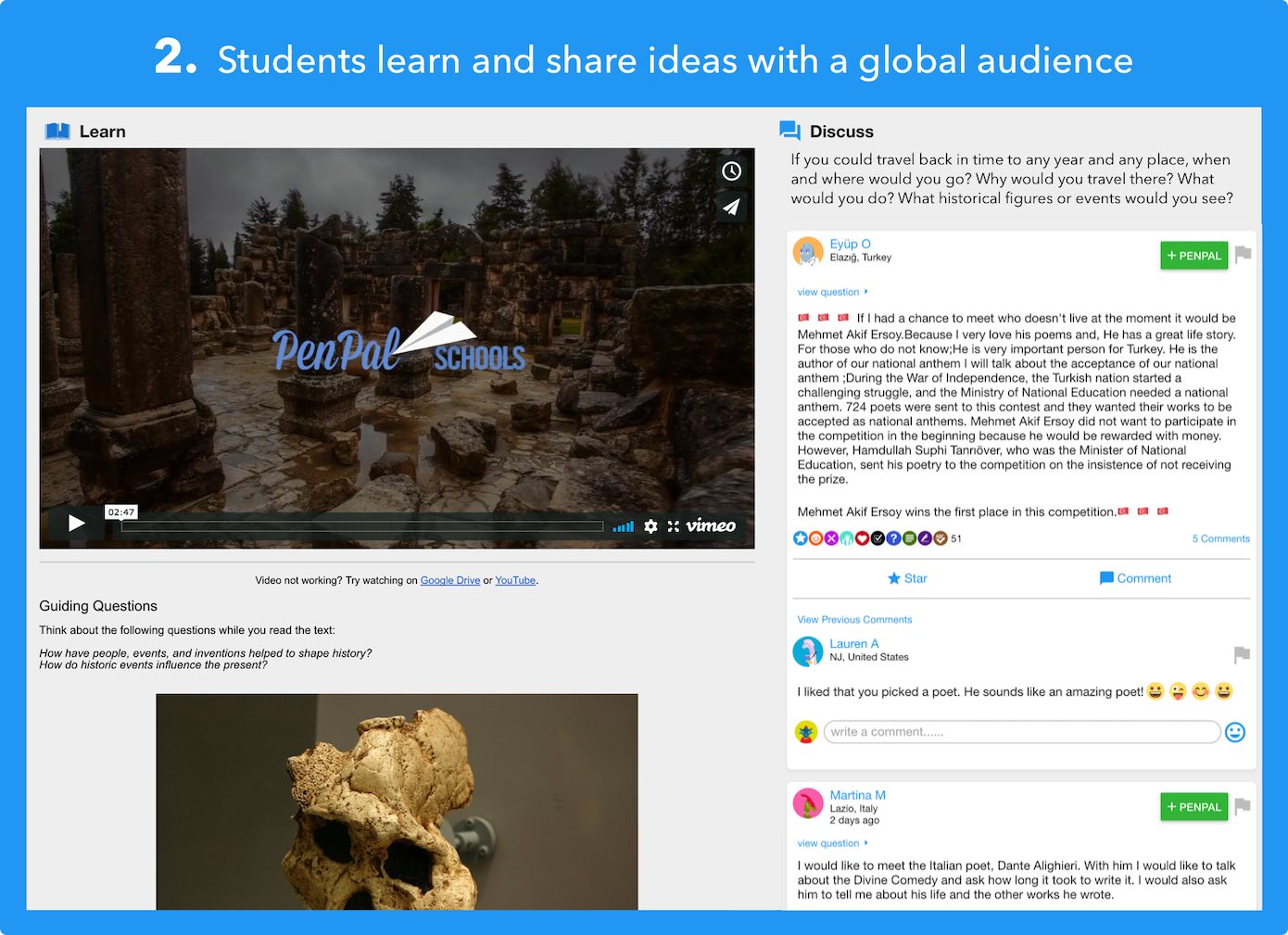

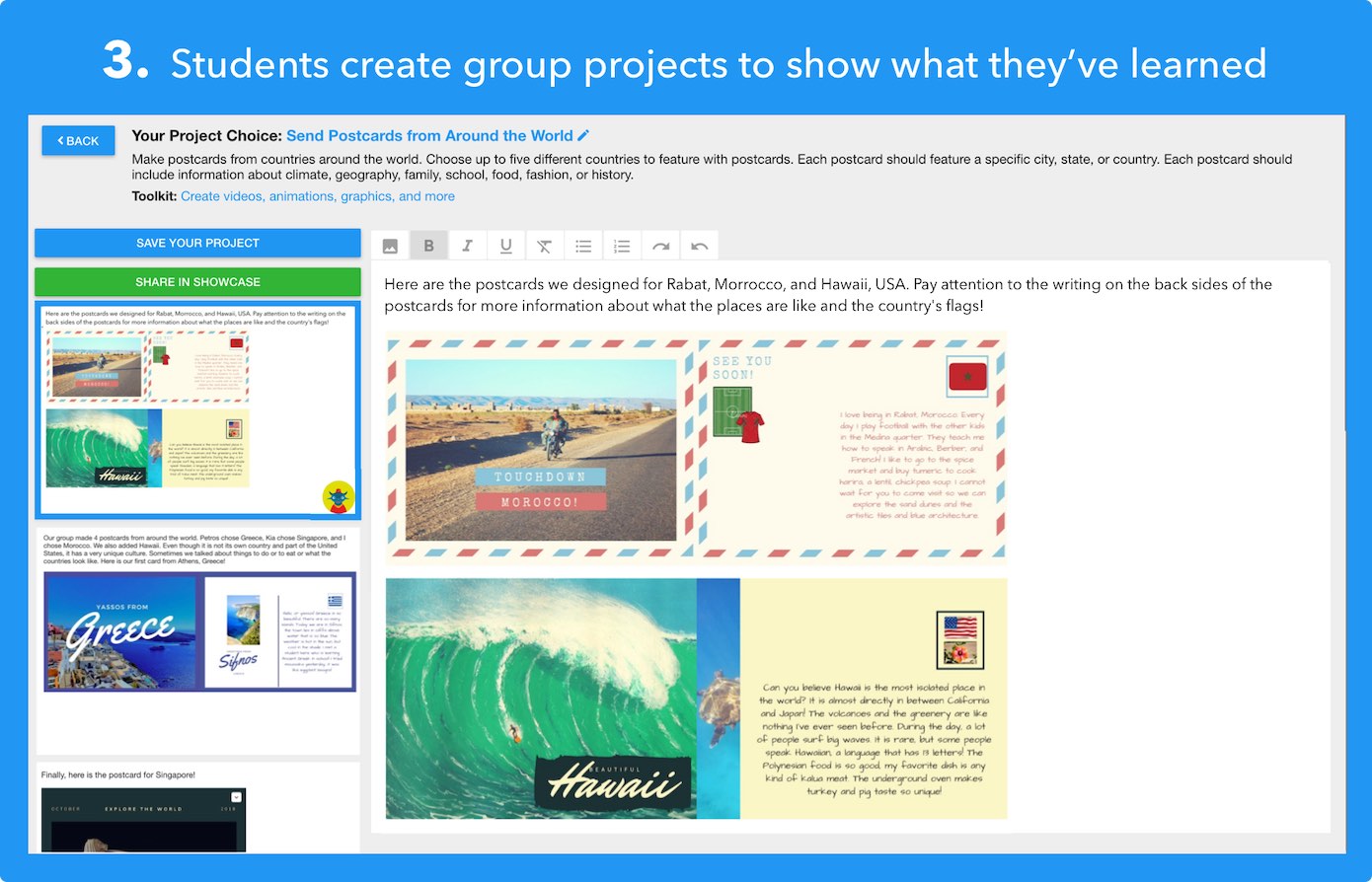

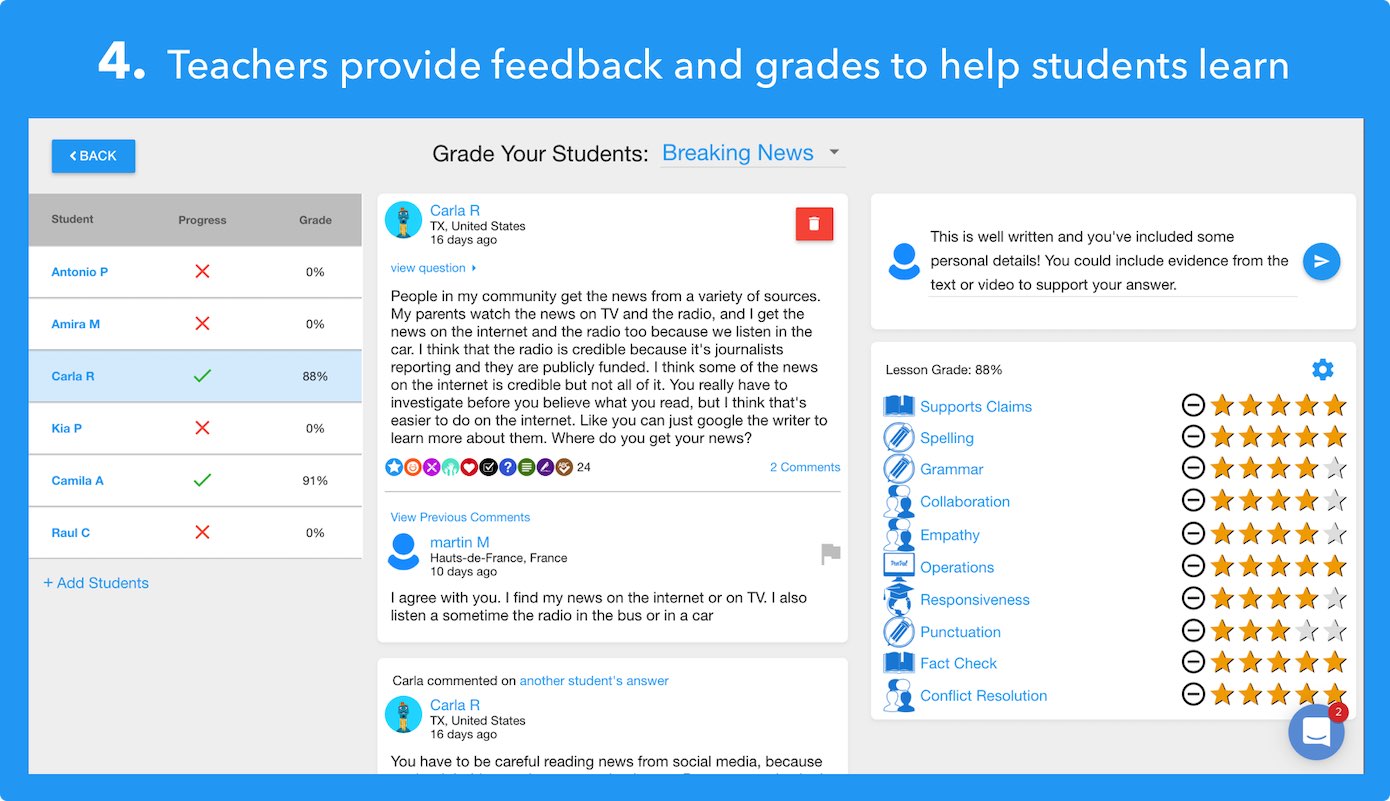

How Penpal Schools works

These screenshots are nice, but to really get a feel for PenPal Schools you should see a demo. Pick a topic of your choice and preview it to see the quality of the content and technology. The demo looks pretty good on a phone, but it's optimized for a laptop - the way 90% of our students use it.

The market

As you may already know, the K-12 education industry is very large. In the United States alone, there are over 98,000 public schools and 33,000 private schools serving a total of over 56 million students. These schools spend a total of $12.4 billion per year on instructional supplies.

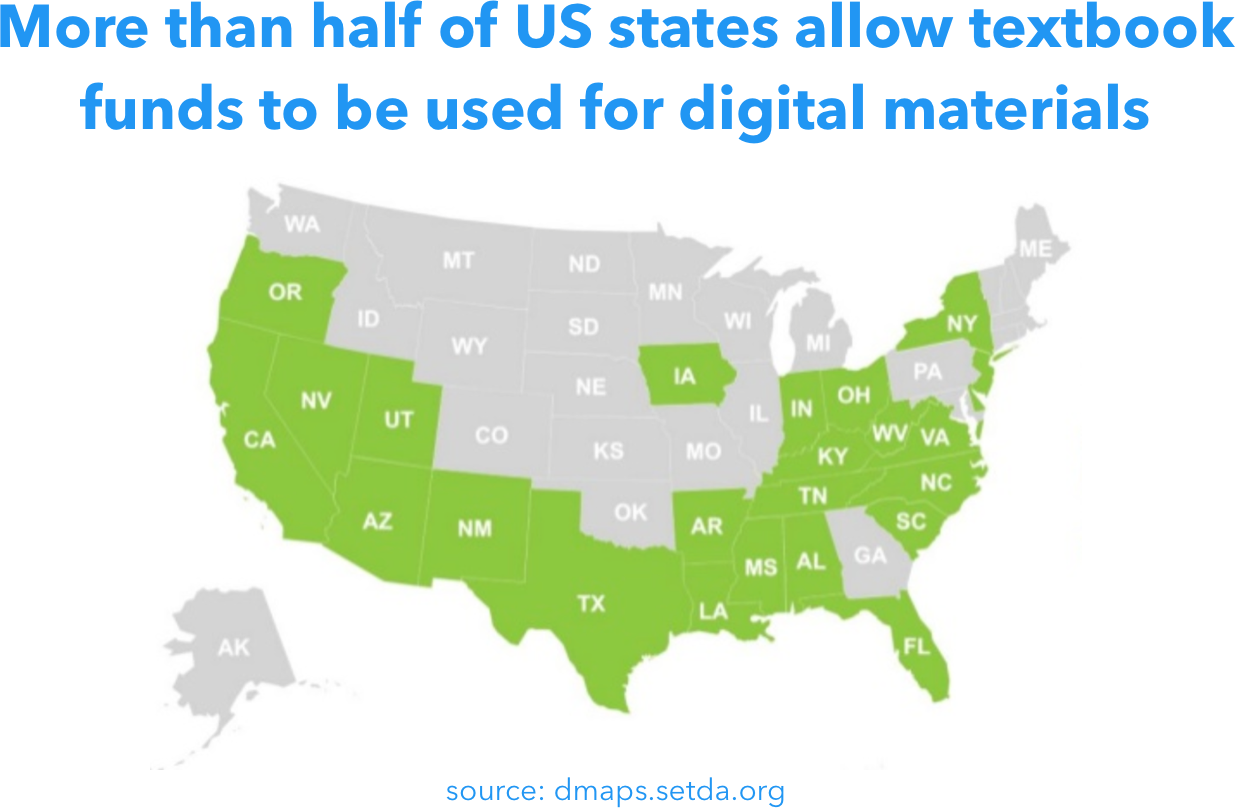

What you may not know, unless you spend a lot of time in schools, is that classrooms today look very different than they did just a few years ago. Schools everywhere recognize the need for students to practice using technology, and are replacing worn out textbooks with digital instructional materials. Today, 98 percent of US school districts provide internet access for students.

Just as classrooms are shifting from textbooks to technology, so are the budgets of schools and school districts:

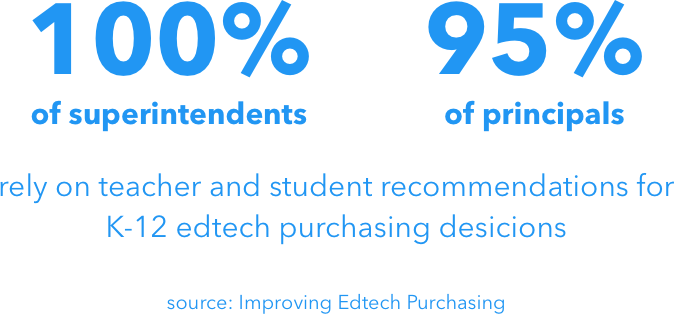

In addition to what they purchase, schools and districts have also changed how they purchase. In the past, large textbook publishers sold their products by schmoozing administrators with fancy dinners or golf outings. This was great for administrators, but often forced students and teachers to use ineffective products. Fortunately, today schools and districts demand free trials (pilots) of digital resources to make sure that they are effective. This is great for students and teachers, as well as for the companies that have built the products that they love. Like, for example, PenPal Schools.

Penpal Schools' business model fit perfectly with this teacher-driven purchasing system

Teachers can complete any two topics for free on PenPal Schools. After completing their free trial, teachers are given the option to encourage their principal to purchase a license for the school (we don’t believe in charging teachers).

Since implementing this system in 2017, PenPal Schools has sold licenses to 75 schools and 3 districts:

The sales pipeline for 2019 is very strong, with revenue expected to surpass expenses in March based on sales to individual schools alone. In addition, news of PenPal Schools has reached administrators from some of the largest school districts in the US, and pilots are currently underway with 8 districts representing a combined total of 591 schools. Students and teachers from these districts are already using PenPal Schools and sharing their feedback with district administrators, who will make purchases in the Spring for the 2019-20 school year.

What's next

Spring 2019 - PenPal Schools will hire additional account managers to increase sales and manage existing relationships. These account managers will field inbound leads generated from free trials while also focusing on business development with large school districts.

Summer 2019 - PenPal Schools will introduce a mobile app for parents. The free version of this app will enable parents to see the amazing projects that their children create with peers around the world. For a small monthly fee, parents will be able to enroll their children in additional topics beyond those selected by the teacher. Premium subscribers will also have access to advanced analytics and recommendation features, made possible by the thousands of assessments that students receive from peers and teachers.

This freemium parent app will enable PenPal Schools to enter the fast-growing home education market. With US children ages 8-12 spending an average of 6 hours per day online, parents are increasingly willing to pay for educational apps to ensure that screen time is well-spent. While reliable statistics for the size of the home education market are not yet available, the impressive valuations for companies focused on sales to parents, such as ABCmouse and Classdojo, demonstrate the common belief amongst education investors and analysts in the strength of the home education market.

Investors

PenPal Schools has raised a total of $1.25M from a mix of angel and institutional investors.

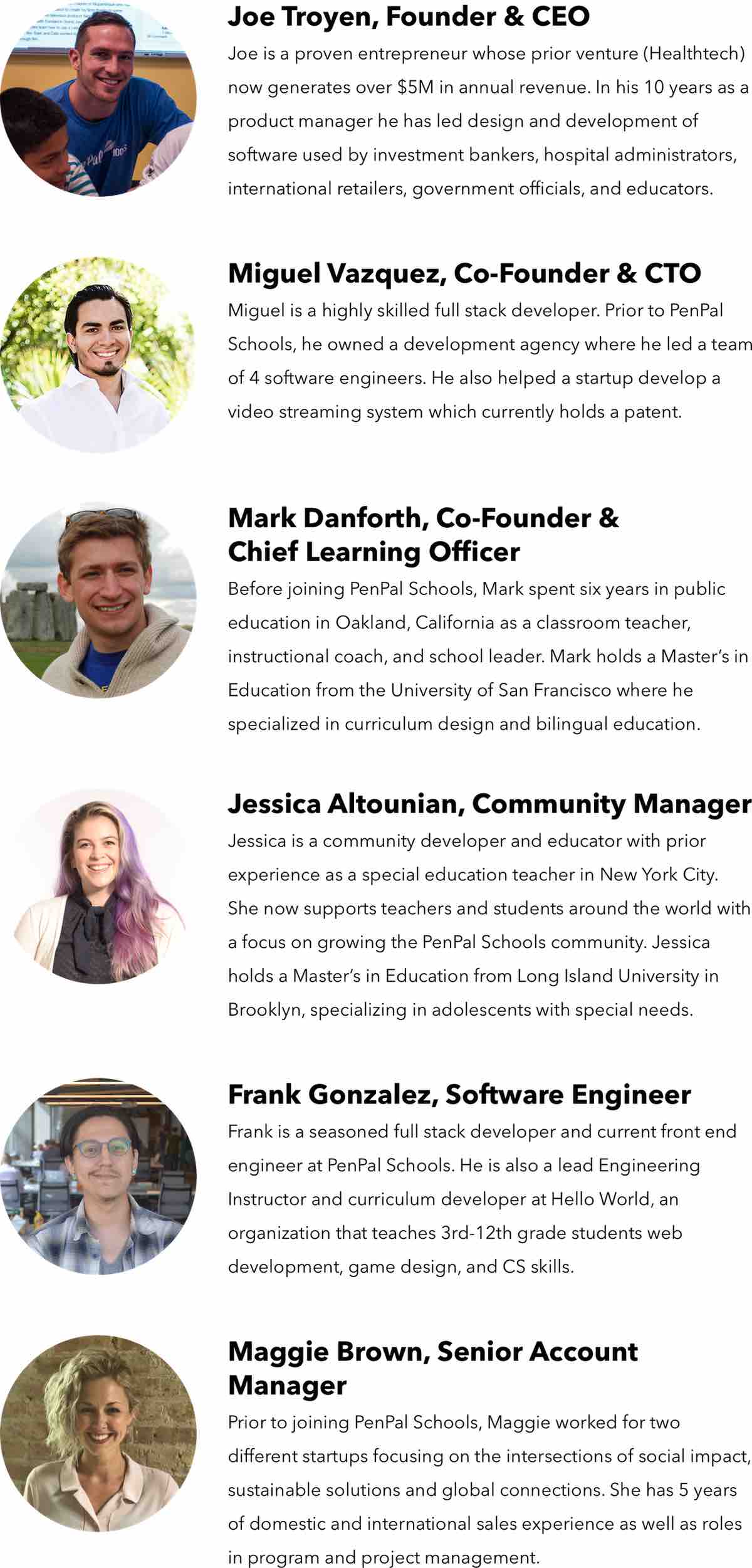

Meet our team

Join us in making education global, fun, and engaging for students everywhere!

We are especially excited to invite educators to invest in PenPal Schools! Our program has grown and evolved thanks to the support of some truly amazing teachers and administrators. We are so grateful for all you have done for us and for your students, and we are thrilled to offer you the opportunity to share in our success. - Joe

Deal terms

$12,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for PenPal Schools occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

PenPal Schools must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Sponsor a school! Includes unlimited free access for a school of your choice for an entire year! During teacher training we will publicly thank you for your sponsorship (unless you prefer to remain anonymous).

- Sponsor two schools!

- Sponsor five schools!

- Sponsor ten schools!

About PenPal Schools

PenPal Schools Team

Everyone helping build PenPal Schools, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC