Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Coinvest

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

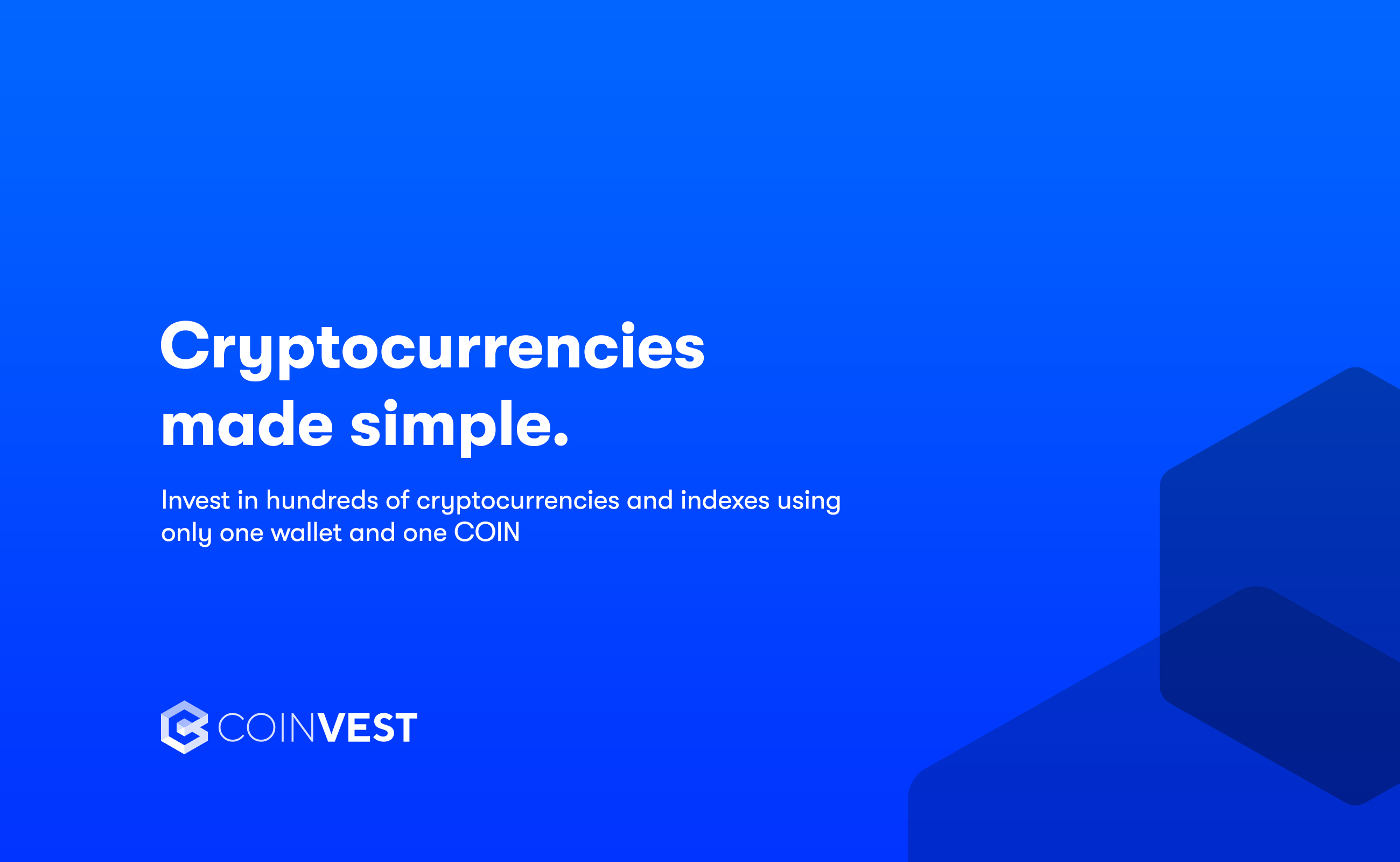

Coinvest will be a single destination for users to learn, invest, and spend cryptocurrencies. The Coinvest ecosystem (built by Coinvest LLC, the parent company of Coinvest Labs LLC's, together "Coinvest"), will consist of a wallet and investment trading platform to handle all of your cryptocurrency investment needs. The Coinvest trading platform will enable anyone to easily invest in hundreds of different cryptonized assets and indexes using only one wallet and one coin.

The Coinvest Labs investment process will be managed by smart contracts which will be the custodian of the network. User invested funds will be held by the smart contract until withdrawn by the user. Third-parties, including Coinvest, NEVER have access to invested funds, including the reserve pool that collateralize and back all investments traded in the network. Once an asset is sold from a user’s portfolio, COIN will be returned to a user's wallet and can be spent directly using our built-in debit card account.

Since the invention of blockchain technology, a new asset class has emerged in cryptocurrencies. Built on the blockchain technology, these digital currencies offer the promise of reinventing the real economy, as their decentralized nature, better security, and faster processing are vast improvements over traditional financial systems.

Unfortunately, these investment opportunities are largely limited to high net worth individuals and sophisticated investors. Ironically, this is contrary to the ideals of blockchain as a force for decentralization and democratization. For ordinary investors who want to invest in cryptocurrencies, they face issues such as complexity, fragmentation, lack of quality market intelligence, and security risks.

- Investing in cryptocurrencies is too complicated

- The market is highly fragmented

- High fees

- Lack of liquidity

- Lack of quality market and investment data

Coinvest Labs will be an open-source for-profit technology company dedicated to:

“Democratizing cryptocurrencies and bringing it to the masses by creating decentralized tools for the world to seamlessly invest and spend cryptonized assets.”

Frustrated with the complexity, fragmentation, and quality of cryptocurrency investment options available on the market, Coinvest Labs is determined to democratize cryptocurrencies by creating tools that will:

- Provide mechanisms for consumers to seamlessly, securely, and safely invest and use cryptocurrencies

- Empower anyone to invest in hundreds of different cryptonized assets and indexes using one wallet and one coin

1. Create a virtual portfolio with your favorite cryptocurrencies

2. Trade and Withdraw Investments (+ Profit) Directly with our Smart Contract

3. Easily spend cryptocurrencies using your debit card account

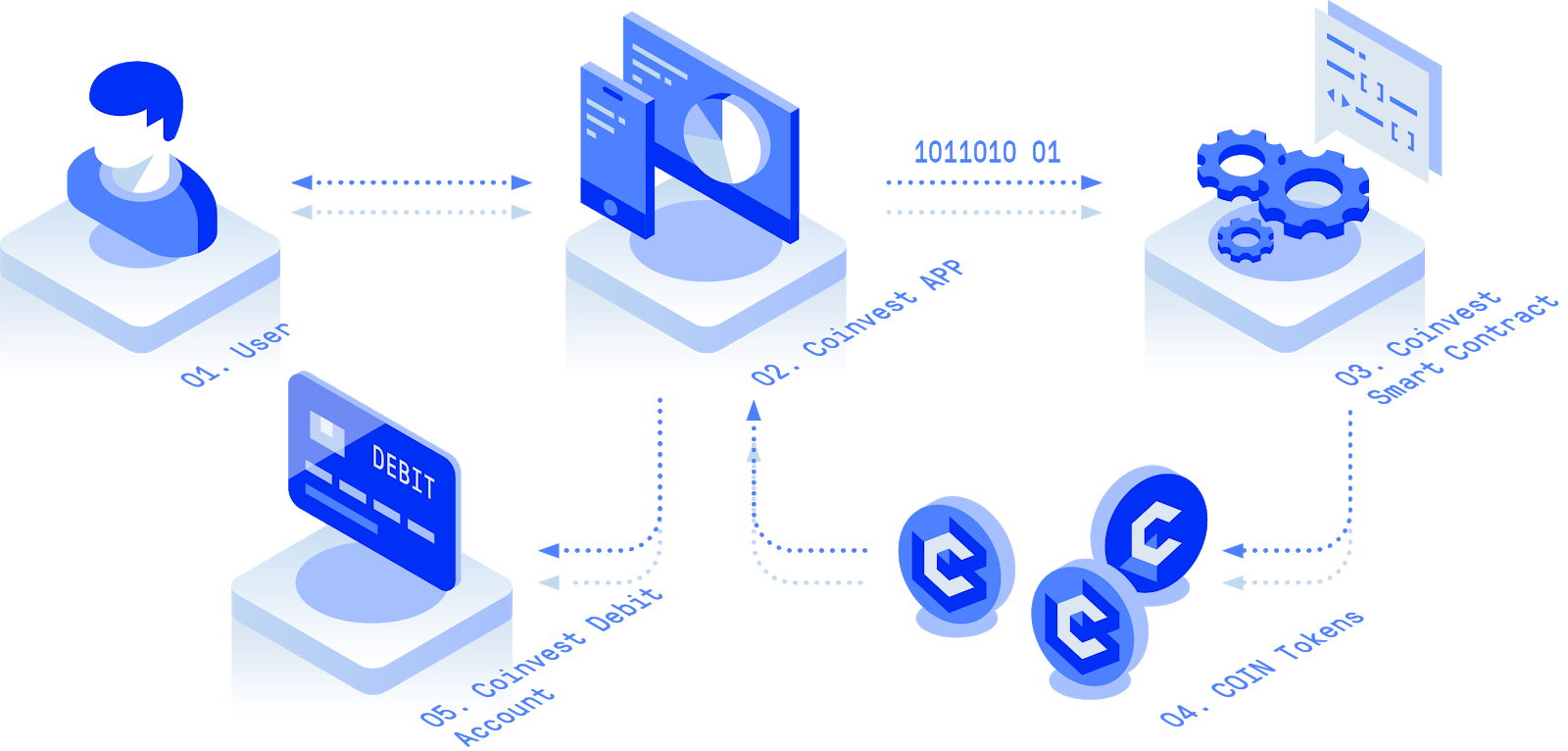

Sample real-world use-case: Mary wants to invest in cryptocurrencies and purchase Bitcoin, NEO, and Raiblocks. With today’s solutions, Marty would have to:

- Search and find all of the exchanges that support these assets

- Execute KYC checks for each exchange

- Place a total of three individual trades and incur % fees for each trade

- Manage three wallets to support each protocol

- Manage three sets of private keys

- Sell and convert her assets to fiat currency before being able to spend them

With Coinvest Labs, Mary will be able to execute all of the above in one trade, for one fee ($4.99) and manage only one wallet. From there, spend COIN directly from their wallet without having to convert it back to fiat currencies (using our built-in debit card support).

The Coinvest Labs ecosystem of products and services will interact and complement each other to provide a comprehensive end-to-end investment experience for our consumers.

Details on our offerings are below:

COIN Protocol

At the core of its product portfolio is the Coinvest Labs protocol; A blockchain protocol defining investment transactions between users and the Coinvest Labs smart contracts. User invested funds will be held in smart contracts while investment data is written to the blockchain, removing all third-parties from the investment process. The COIN protocol will enable developers to build their own DAPP and become their own broker to help increase the adoption of COIN.

Coinvest Trade

Coinvest Trade is a wallet and decentralized software application (DAPP), or front-end interface to the COIN protocol. The Coinvest DAPP will empower anyone to invest in individual or a curated index of cryptonized assets using only one wallet and one COIN. Users will create virtual portfolios and trade their favorite cryptocurrencies using market buy, limit buy, sell, and short orders.

CoinDNA

Investing starts when an investor begins their research. Not once a trade is placed. At Coinvest Labs, we aim to be a single destination for investing in cryptocurrencies. CoinDNA is a place for blockchain enthusiasts to consume a combination of Data, News, and Analytics on a daily basis. Using content and insight, CoinDNA builds trust and confidence with investors which aids in conversion to the Coinvest Trade platform.

Cryptocurrencies and the blockchain industry are scratching the surface in global adoption and usage. Yet:

- Global trade volume (24 hour period) in cryptocurrency markets recently surpassed $50B+

- Cryptocurrency market capitalization is approximately $500B

- Global adoption of cryptocurrency market is estimated at > 0.5%

- Coinbase exceeded $1B in trading revenue in 2017

- Binance achieved $850M in trading revenue in 2017

- Developed the COIN protocol and smart contracts

- Developed and released a MVP prototype

- Upgraded to V2 of the COIN protocol and smart contracts

- Filed as a MSB with the US FinCEN and provided notice to the US SEC on its offerings.

Prior to starting Coinvest Labs, Damon Nam was a sixteen year IT services professional at Microsoft. During his tenure, he assumed three different management roles within the Microsoft Services organization. In his last role as a US Services Partner Program Director, he was responsible for driving and managing the Preferred Services Partner program for the US; a program with approximately seventy-five partner organizations and a total book of business of over $90 million in revenue. Damon is responsible for architecting and executing the strategy to drive the overall mission for Coinvest Labs.

Kevin Huynh has built a career in data analytics, most recently graduating from Carnegie Mellon University with a Masters in Business Intelligence and Data Analytics and managing digital marketing for Hotels.com. Prior to that he consulted as a Senior Data Modeler for many top Fortune 500 companies, including McKesson, Kimberly-Clark and Rubbermaid. Kevin is responsible for Coinvest Labs analytics and operations strategy.

Byron Levels has 23 years of experience as an IT services professional with a wide range of expertise in developing solutions to help businesses succeed. Byron has worked for many Fortune 500 companies including Microsoft, AT&T, and American Airlines. Byron is an architect and application developer with a strong focus on e-commerce and business application integration. Byron is responsible for driving the architecture, implementation, and support for all technology needs for Coinvest Labs.

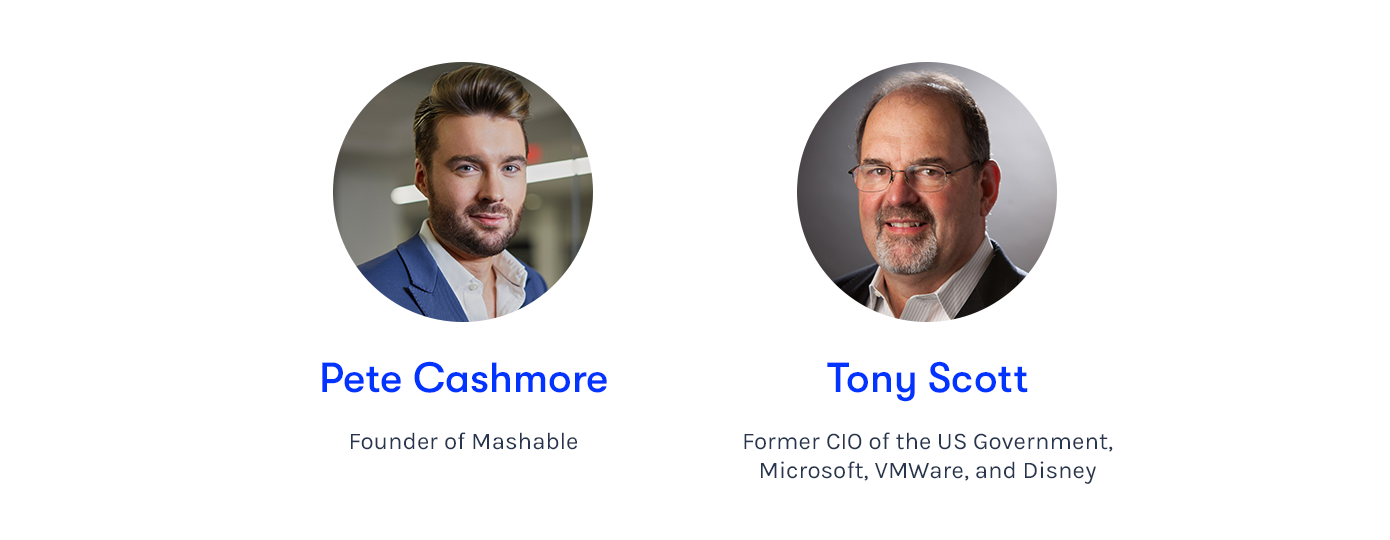

Tony Scott and Pete Cashmore are respected leaders within their industries and offer significant value beyond marketing purposes. Coinvest Labs is here for the long-term. Our team has worked very hard to carefully engage advisors that can help us grow and scale our business versus offer only promotional value.

Tony Scott was the third U.S. Federal Chief Information Officer, serving from 2015–2017. Scott’s 40 year career in information technology includes roles as Chief Information Officer of VMware, Microsoft and The Walt Disney Company. Scott also serves as a research director at the Blockchain Research Institute, a global knowledge network. Coinvest Labs will be able to leverage Scott’s vision and expertise to help the company with IT management, operations, and security. Scott also advises for other companies within the blockchain industry such as Cobinhood and Continuum, and his network is a resource for Coinvest Labs as well.

Pete Cashmore is the founder of the leading tech publication, Mashable. Cashmore has grown Mashable from a blog project to a global tech-focused media company boasting 42 million monthly unique visitors and 21 million social media followers. Cashmore was named one of Time Magazine’s 100 Most Influential People in 2012, featured on Forbes 30 under 30 list, and was named a Young Global Leader by The World Economic Forum in 2011. Under Cashmore’s leadership, Mashable has been on the forefront of this transition and a pioneer in the digital content creation and advertising space. Coinvest Labs will be able to leverage Cashmore’s vision and expertise to help the company build a platform focused on community with insights to growth scaling and media. We are honored to have his insight, experience, and vision in the areas of media and emerging technology to aid our company.

In the video below we had a chance to sit down with Pete to learn his thoughts on the current and future state of the blockchain industry.

Deal terms

$1.07M

Coinvest must achieve its minimum goal of $100K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Token DPA (Late Stage with Escrow)

If the campaign is successful, you’ll receive a Token DPA for your investment.

The DPA is not equity or a token itself, but a loan that payable in tokens in

the future, with interest.

Learn more

3 years

The amount of time Coinvest has to pay out your investment in tokens.

If the DPA isn't repaid with tokens after that time, it will be payable in cash

with interest.

Learn more

15%

The interest amount that will accumulate on your investment

if it’s paid back to you in cash.

Learn more

10% before 6 months, then 20% if repaid before maturity

The interest amount that will accumulate on

your investment if it’s paid back to you in tokens.

Learn more

75% of net debt amount before 2 years

How much you can get back of your investment if you choose to cancel

the Token DPA before it’s paid back.

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

About Coinvest

Coinvest Team

Everyone helping build Coinvest, not limited to employees

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC