Whether you like it or not, the labor landscape has shifted. Over the last few years the idea of working until retirement...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Moonlighting

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

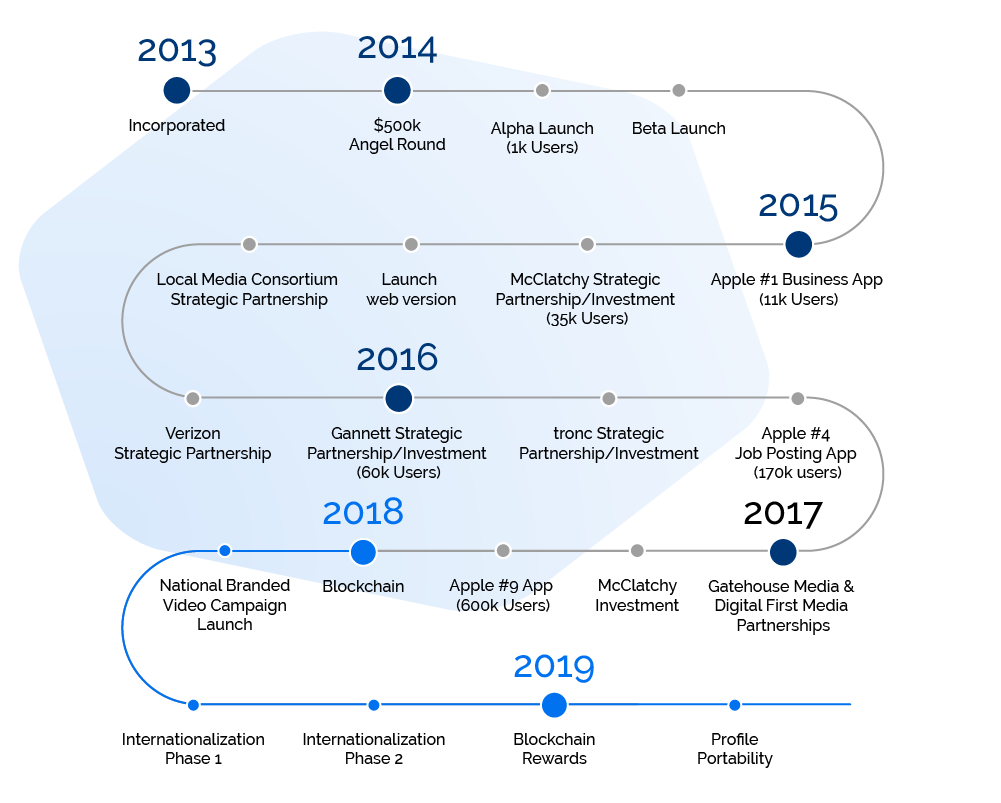

- Grown to more than 650,000 registered users in all 50 states since launching in 2014

- $6M+ raised from investors like new media companies Gannett, Tribune, and McClatchy

- Top 10 mobile app in the iOS App Store “Jobs” category for over two years

- Taking the “Gig Economy to the Next Freelancing Level” - Forbes

- Currently incorporating blockchain technology to make hiring online safer and more trusted

By 2030, Freelancers Will Account For as Much as 80% of the Global Workforce

Traditional Hiring Platforms Aren't Ready

The growth of freelancing worldwide is staggering. In the US alone, freelancers make up 35% of the current workforce, some 55 million workers who collectively earned $1 trillion in 2016. That number is predicted to reach 43% by 2020, with some analysts citing that figure at 80% of the global workforce by 2030.

While the freelance economy is booming, participants are at the mercy of flawed and individually-centralized job marketplaces. These traditional marketplaces struggle to engage new members and eliminate fraud, all while controlling freelancer earnings by setting pay rates, taking a steep cut of earnings, charging for bids, and withholding or even denying payment. As a result, freelancers are powerless to control their personal data and retain their full earnings. Conversely, employers have limited access to consistent, trusted, and verified worker data, putting them at the risk of losing money and wasting time in the process.

The Solution: Moonlighting

On a Mission to Help Millions

A few years ago, we started Moonlighting to help empower people everywhere to pursue the career they always wanted, to lead a better life, and to do work that they truly love. We wanted to create a free and open marketplace that gives everyone a shot at getting discovered and building their own workplace independence. This mission has turned into a movement, spreading quickly throughout the country and soon, across the globe.

A More Trusted, Global, and Inclusive Freelance Economy

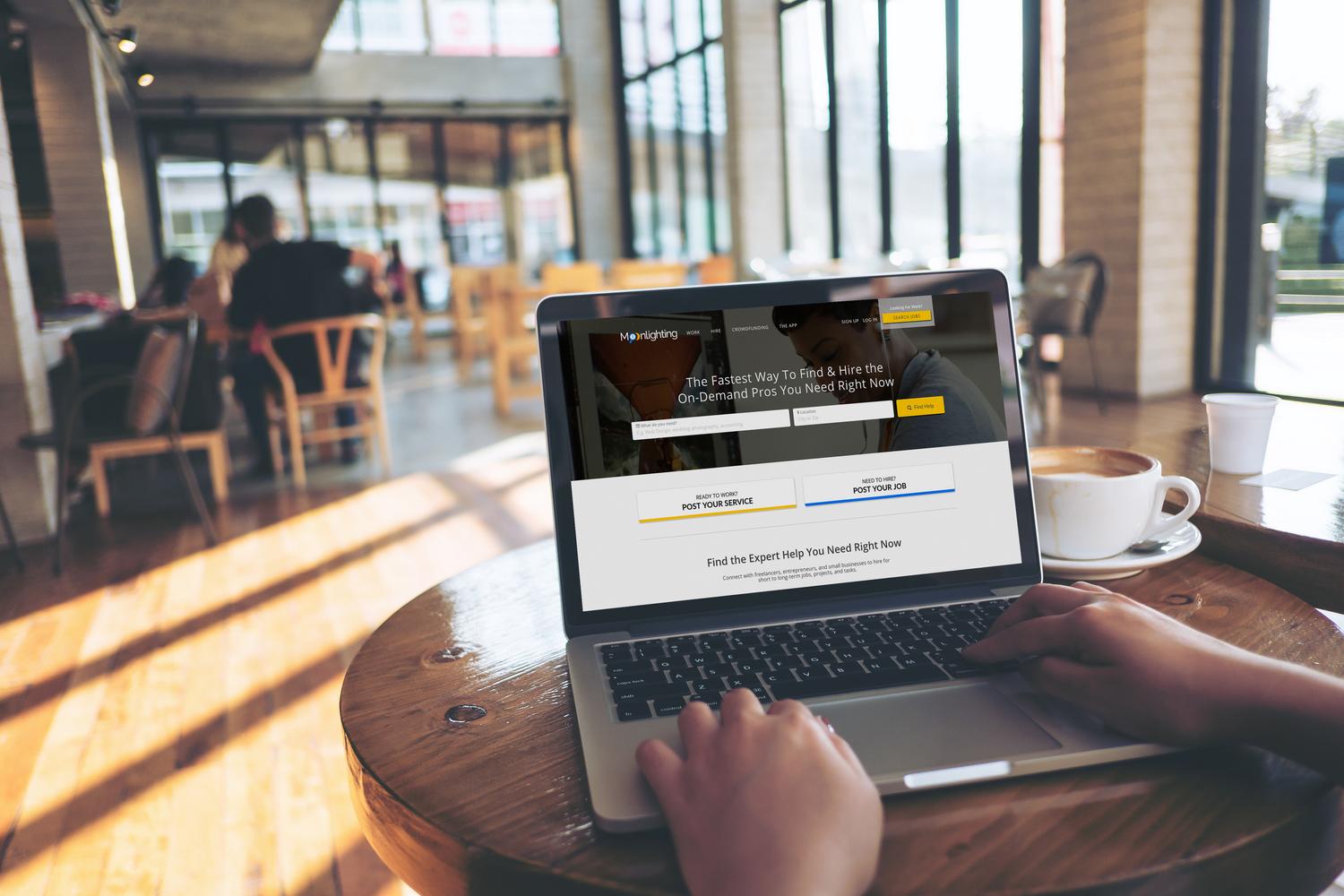

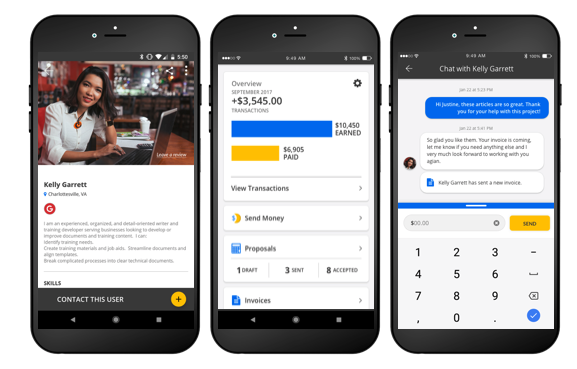

Moonlighting removes the middleman between employers and freelancers, connecting them directly to empower on-demand employment. In addition, it offers a suite of powerful SaaS tools that simplify communications and small business accounting.

With the upcoming blockchain integration, Moonlighting will decentralize worker profiles (including reviews, recommendations, education, licensing credentials) and allow freelancers to port their profile to any employment marketplace in the gig economy.

Removing the middleman

Thanks to the peer-to-peer model, platform commission fees are eliminated.

Providing powerful SaaS tools

Moonlighting provides a full turnkey solution with a suite of tools including online portfolios, instant chat to accept direct hire requests, proposals, invoicing, and online payments.

Getting a blockchain upgrade

Trust is a major problem for freelancers and employers. With the upcoming blockchain integration, once a blockchain profile is created on Moonlighting, independent workers will no longer have to create and maintain multiple online profiles. They can simply port their profile and earned reviews to other participating platforms providing employers with more consistent and accurate ratings and profiles. No more guessing which source(s) to trust – Moonlighting blockchain user profiles will make hiring online safe and trusted.

The blockchain integration will allow for faster payments via instant payments through cryptocurrencies.

Blockchain technology also supports tokenization and smart contracts that create new incentives for participation in Moonlighting and the freelance economy. The upcoming Moonlighting Rewards Program will incentivize freelancers and clients to act fairly and professionally, while building a stronger marketplace.

How it works for employers:

Search for the type of worker needed or simply post a job

Qualified freelancers receive job notifications and will begin to respond instantly

Hire the worker you choose and pay securely right through Moonlighting

How it works for workers:

Freelancers create a professional online portfolio

Search jobs and respond to direct hire requests

Accept job requests and receive online payments with no commission fees

Press

As Seen In

Traction

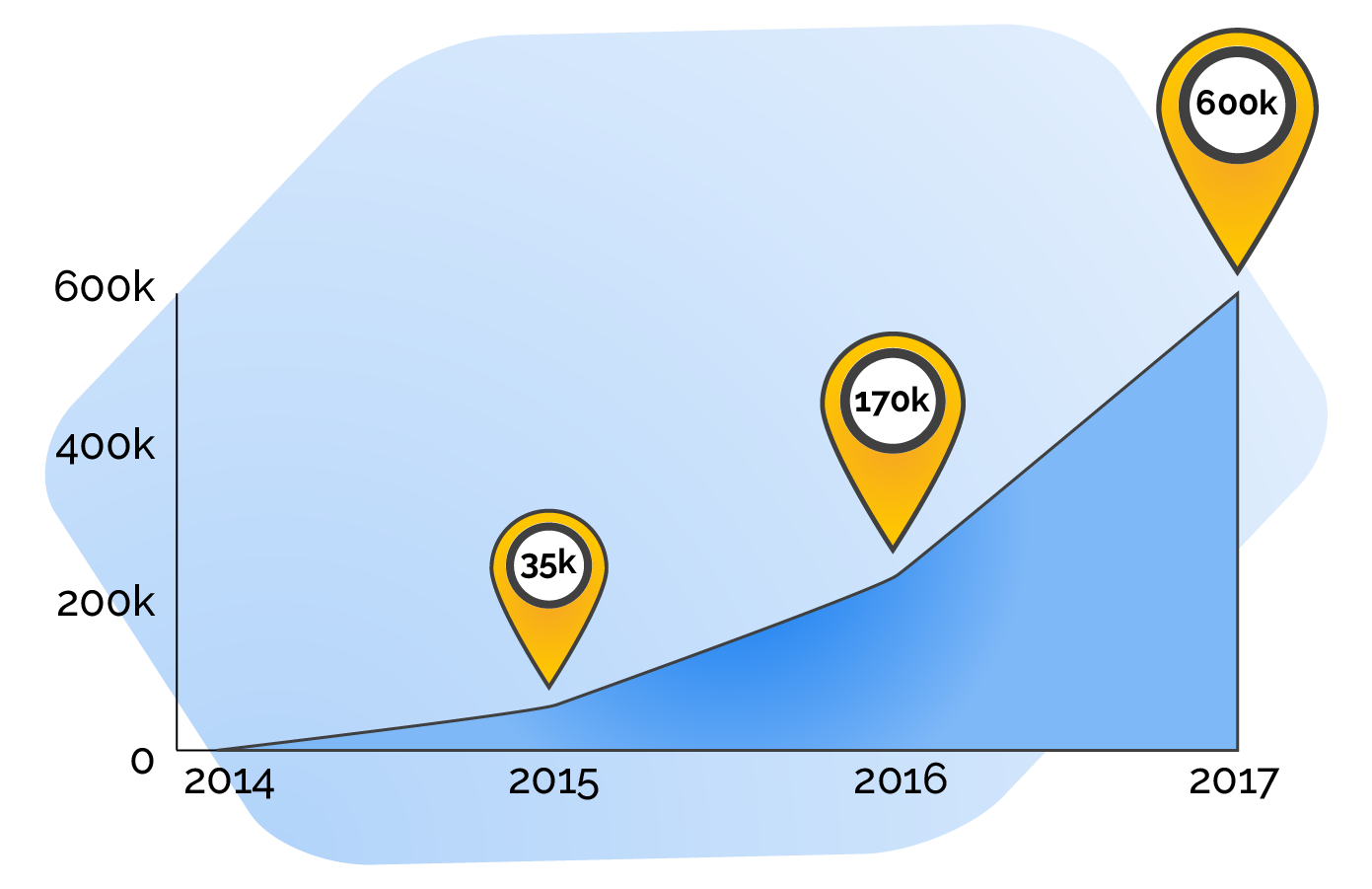

Year-Over-Year Growth Since Launch

Since launch, Moonlighting has gained great traction among freelancers and employers across a variety of verticals, from graphic designers to dog walkers, and data scientists to cake decorators. We’ve expanded rapidly, building a user base in all 50 states.

- 650,000 registered users in the United States in all 50 states 1,500+ cities

- Has been a top 10 mobile app in Apple’s “Jobs” category for over two years

From the Moonlighting Community

Revenue Opportunities

How Does Moonlighting Make Money?

In April 2016, Moonlighting began monetizing its freelancer advertising services and SaaS tools, creating the Boost membership, while also monetizing enterprise employer job postings to create a 30-day job posting product called Blast.

In July 2017, Moonlighting partnered with leading recruitment platform, Recruitology, to accelerate recruitment advertising revenue generated through third-party sales of the Moonlighting Blast product. As a result of these monetization efforts, Moonlighting has generated more than $750K in revenue to date.

Moonlighting currently monetizes both the employee and employer sides of the marketplace:

$40-$100 30-day job listings are available for recruiters and small businesses. These job posts enable these users to instantly connect with the best professional flexible, part-time, and freelance candidates to source, recruit, and hire instantly.

$10/mo per user subscription-based offer is available for freelancers and small businesses. This subscription provides promotion within the Moonlighting marketplace, unlimited use of SaaS tools, unlimited direct communication with potential employers, 0% processing fees on payments received through Moonlighting, and will soon include blockchain verified user profiles.

Additionally, we keep 5% commission of funds raised through Moon$hot Stories.

Addressable Market

Moonlighting’s freelance economy market is substantial and only getting bigger, with potential customers that include 7.5 billion freelance professionals worldwide, large and small companies, recruiters and sole-proprietors looking to hire. By 2020, freelancers workers are expected to make up 43% of the US workforce. By 2030, freelancers will account for 80% of the global workforce. If Moonlighting can capture just 1% of this market, it's a multi-billion dollar opportunity.

In the near term, Moonlighting is focused on expanding to two new markets, Canada and the United Kingdom, through partnerships secured with the top news media companies in each country. With this expansion, Moonlighting is on track to grow its user base to 500M+ and generate $100M by 2021.

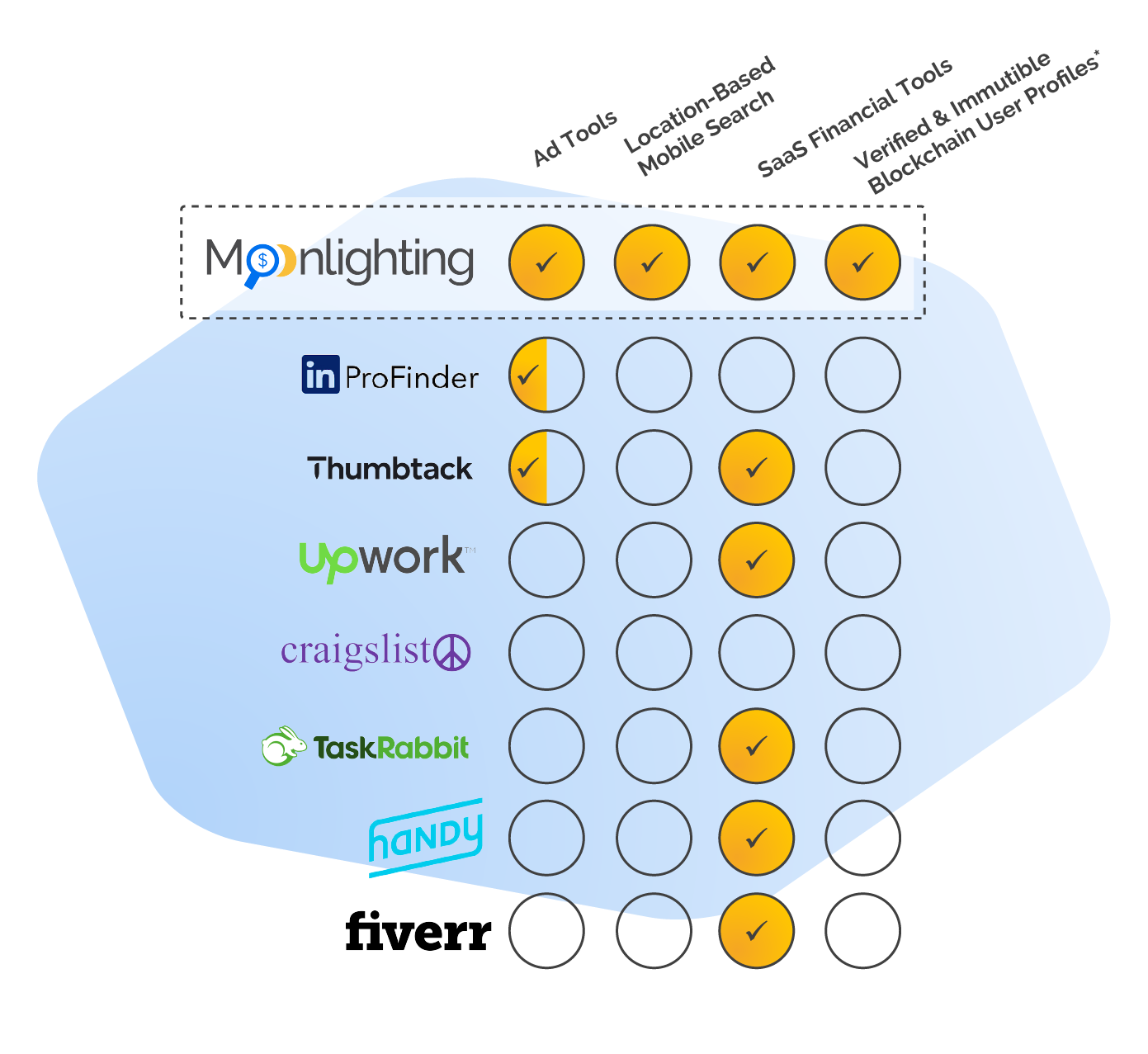

Competition

Our competitors include traditional job marketplaces like LinkedIn, Thumbtack and Upwork. Moonlighting is the only company integrating blockchain technology to build a safer and more secure hiring platform.

*Available 1H'2019

Investors

To date, Moonlighting has raised $6.3M from local Charlottesville, Virginia Angel investor Network (CAN), New Richmond Ventures (NRV), and news media companies McClatchy (NYSE: MNI), Gannett (NYSE: GCI), and Tribune Publishing (NASDAQ: TRNC).

The Evolution of Moonlighting

The Team

Jeff Tennery

Founder & CEO

Jeff Tennery is the founder & CEO of Moonlighting and has spent over 25 years in senior executive leadership roles at Verizon, AT&T Wireless, nTelos, and Millennial Media. Prior to founding Moonlighting, Jeff served 7 years as the Senior Vice President, Business Development & Global Monetization for mobile advertising leader Millennial Media. He was responsible for delivering hundreds of millions of dollars annually across 50,000 applications worldwide and played an instrumental role in Millennial Media’s 2012 IPO.

Ritesh Johar

Co-founder & CTO

Ritesh Johar is co-founder & Chief Technology Officer for Moonlighting and architect of the proprietary mobile payments platform that powers the Moonlighting Marketplace. Before he co-founded Moonlighting, Johar excelled as a Technical lead where he designed, built, and managed the platform that generates $1B+ in mobile & online payments for Capital One. With 13+ years of expertise covering various aspects of software architecture, design, development, process and methodology for the Federal Reserve and Thomson Reuters, Johar brings a wealth of digital payments experience to his new venture.

Roy Slater

Co-founder & COO

Roy Slater is co-founder & Chief Operating Officer for Moonlighting and an operations and process excellence professional with over 20 years of experience leading UI Design, ROI optimization, and mobile technology development. Before co-founding Moonlighting, Slater served as an operations manager at Capital One Financial, where he managed digital properties with revenues more than $1.5 Billion. Proudly hailing from Claremont, California, Slater has also held positions at Lendingtree.com, and GMAC/Ditech.com.

Join Us in Democratizing the Freelance Economy

Deal terms

$28,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for Moonlighting occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

Moonlighting must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- One year complimentary Boost membership ($120/year value), and our heartfelt appreciation.

- One-on-one consultation for the set up and optimization of your Moonlighting account, one year complimentary Boost Membership, and a Moonlighting T-shirt.

- Complementary lifetime Boost membership ($120/year value) + your choice of previous perks.

- "Investor" badge added to your Moonlighting profile + your choice of any previous perks.

- Join our beta tester list and receive first access to new features and releases + your choice of any previous perks.

- ‘Featured Moonlighting’ story about you published and distributed to a national audience + your choice of previous perks.

- Lunch with the CEO + your choice of any previous perks.

About Moonlighting

Moonlighting Team

Everyone helping build Moonlighting, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC