Everytable gets the money Last night's episode of ABC hit business series Shark Tank showcased a local name: Everytable. ...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Everytable

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Innovative restaurant chain selling fresh, chef-crafted meals at fast-food prices.

- "Bite-sized" buildout costs (~$200,000 per location), and simple, efficient store-level operations.

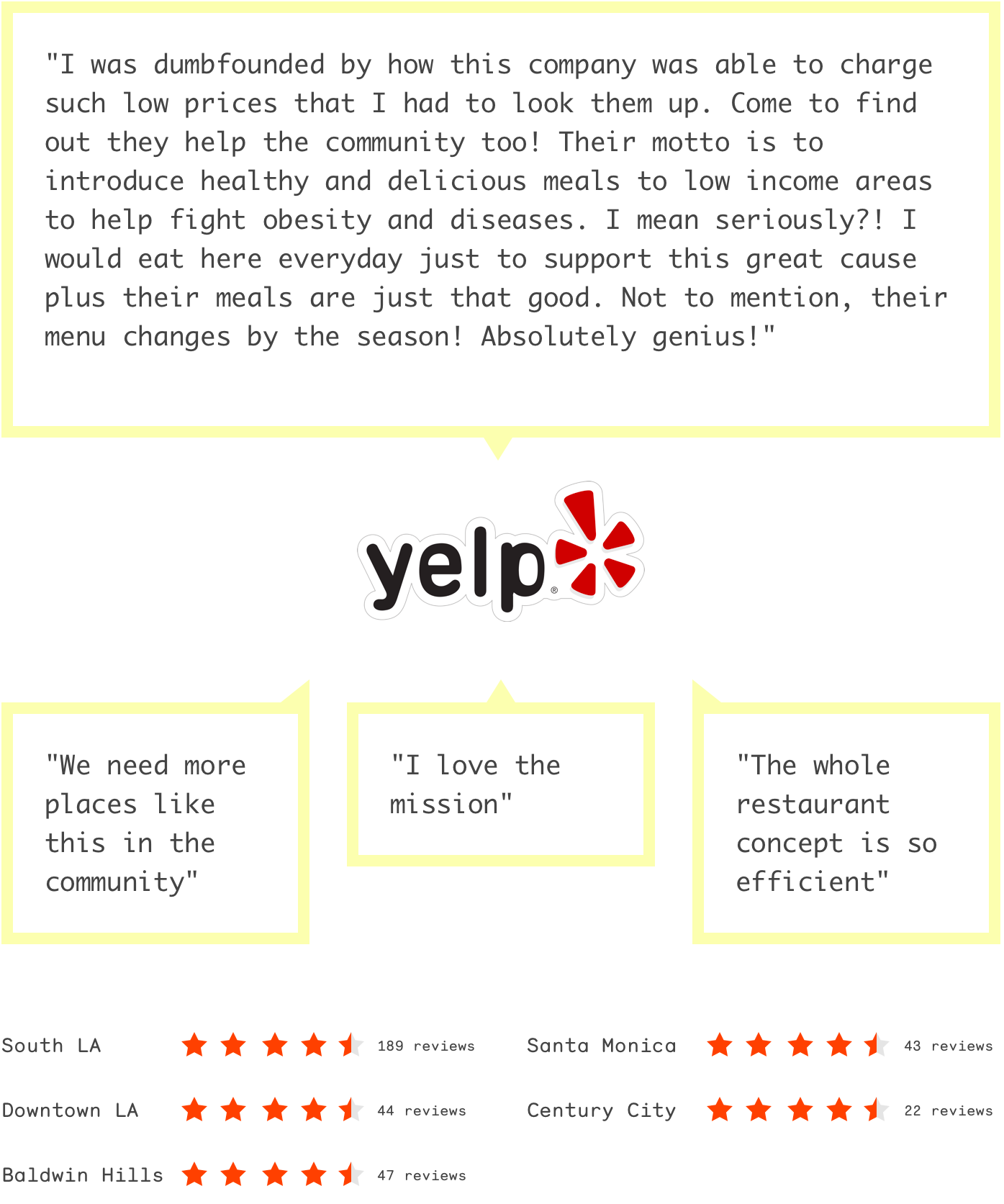

- 4.5+ Yelp Stars in all locations (as of January 25, 2018).

- Covered by 200+ media outlets: Over 2B media impressions!

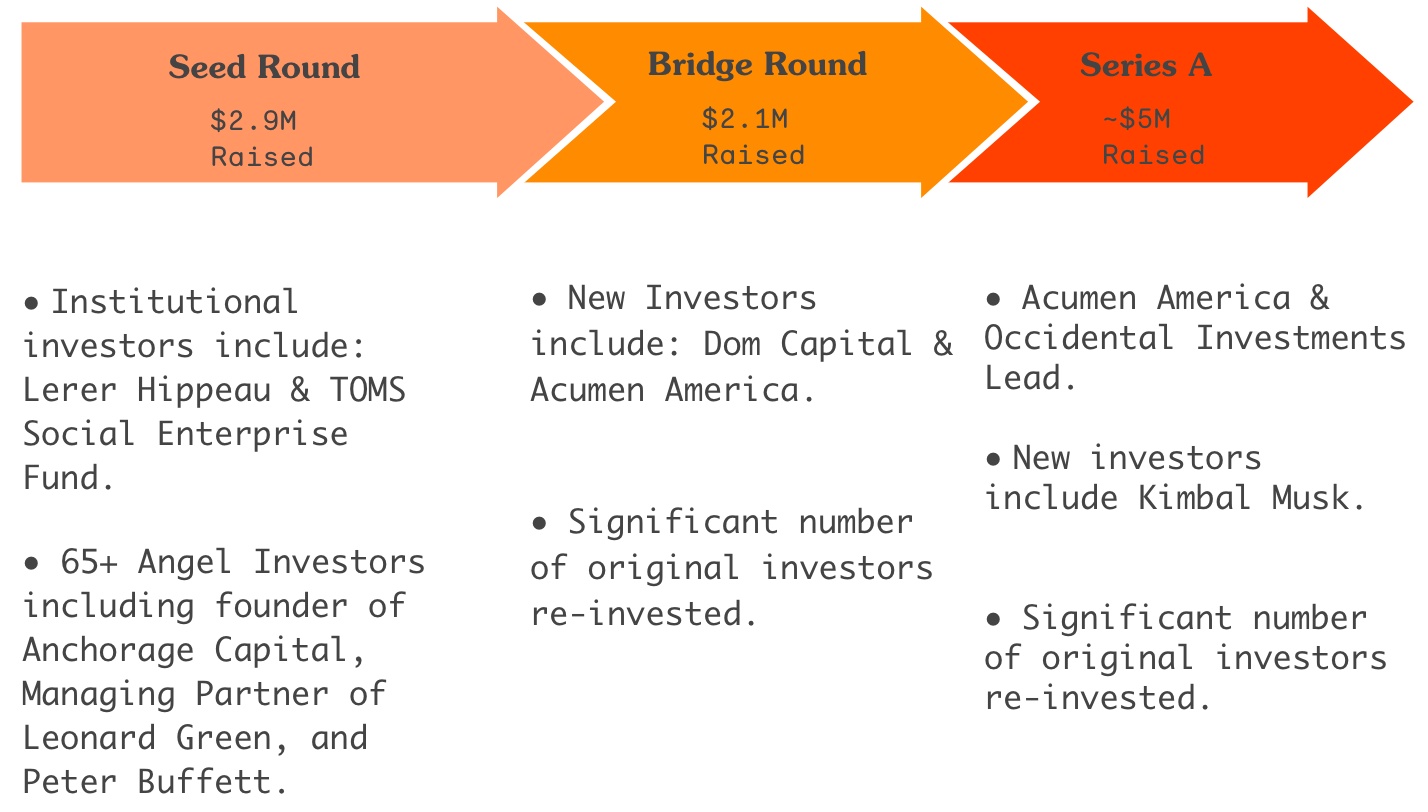

- Raised over $10M from investors include Lerer Hippeau Ventures, TOMS Social Enterprise Fund, Acumen America, M13 Capital, Rams Football Company, Dom Capital, Kimbal Musk, and Jon Sokoloff (Board of Whole Foods).

On almost every major street corner in America, fast food joints sell burgers, fries, and chicken nuggets. These multi-billion dollar businesses have become the landscape of America, the food system itself.

But the world is changing. People are searching for healthier, fresher fare.

Problem

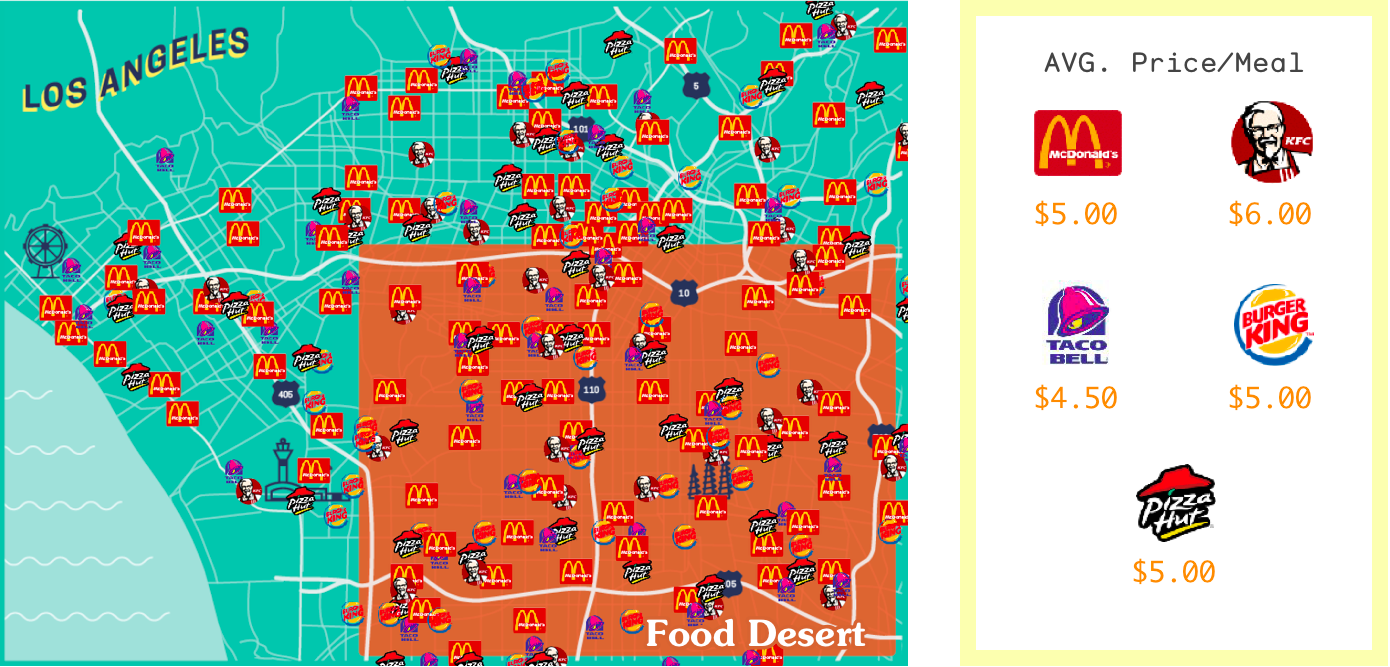

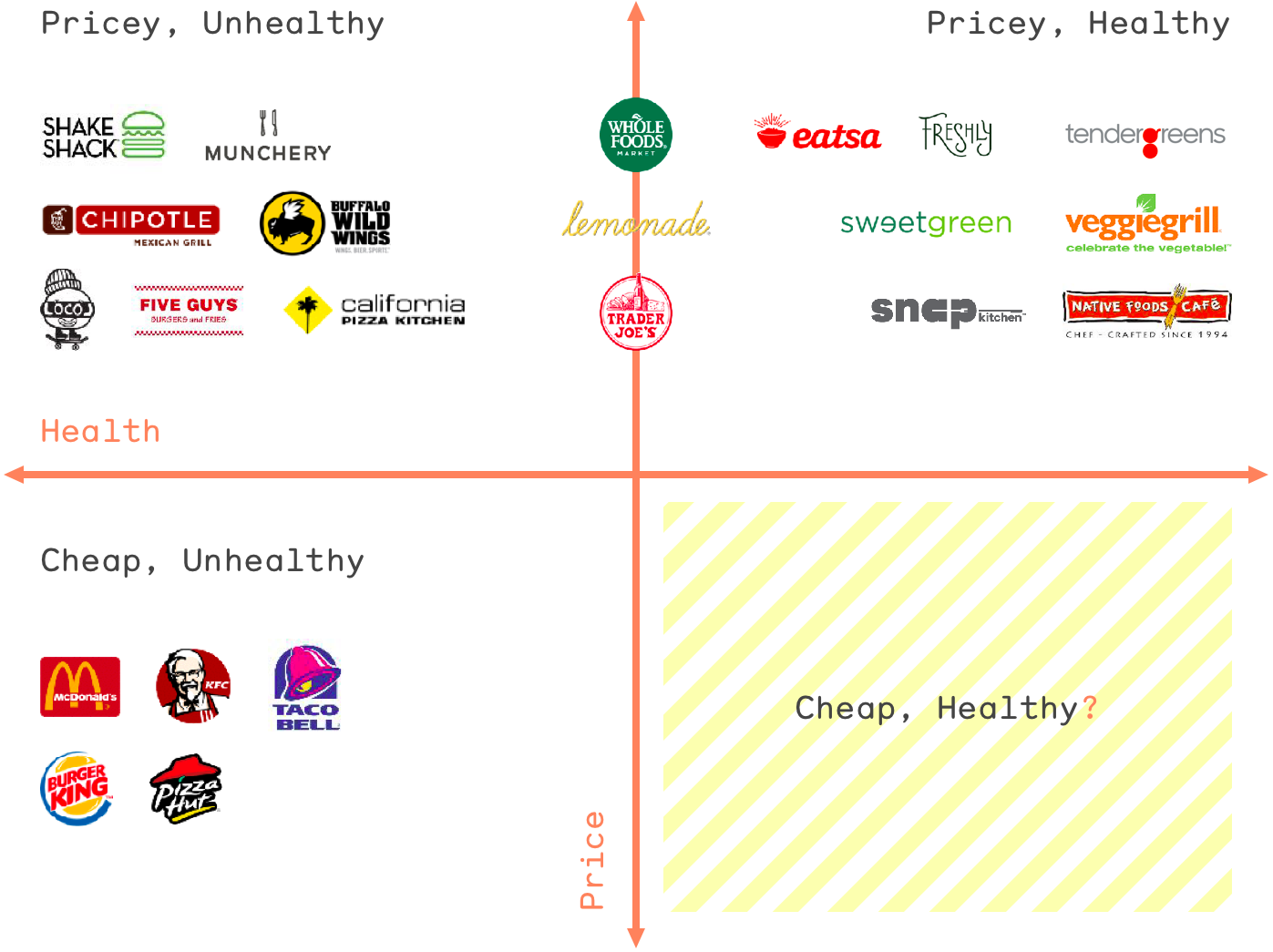

There has been an explosion in demand for nutritious, fresh, and convenient meals, but only in certain markets and at high price points.

Yet there are companies profitably serving all markets at low prices.

Demand for healthy food is exploding, but the truth is that when salads cost $13 and green juice costs $9, healthy food has become a luxury most people can't afford.

And there are some communities, called food deserts, that have virtually no access to healthy food at all.

Solution

Everytable aims to redefine the food landscape the same way McDonald's did fifty years ago. But this time, instead of burgers and fries, we are selling nutritious, fresh food, at fast-food prices.

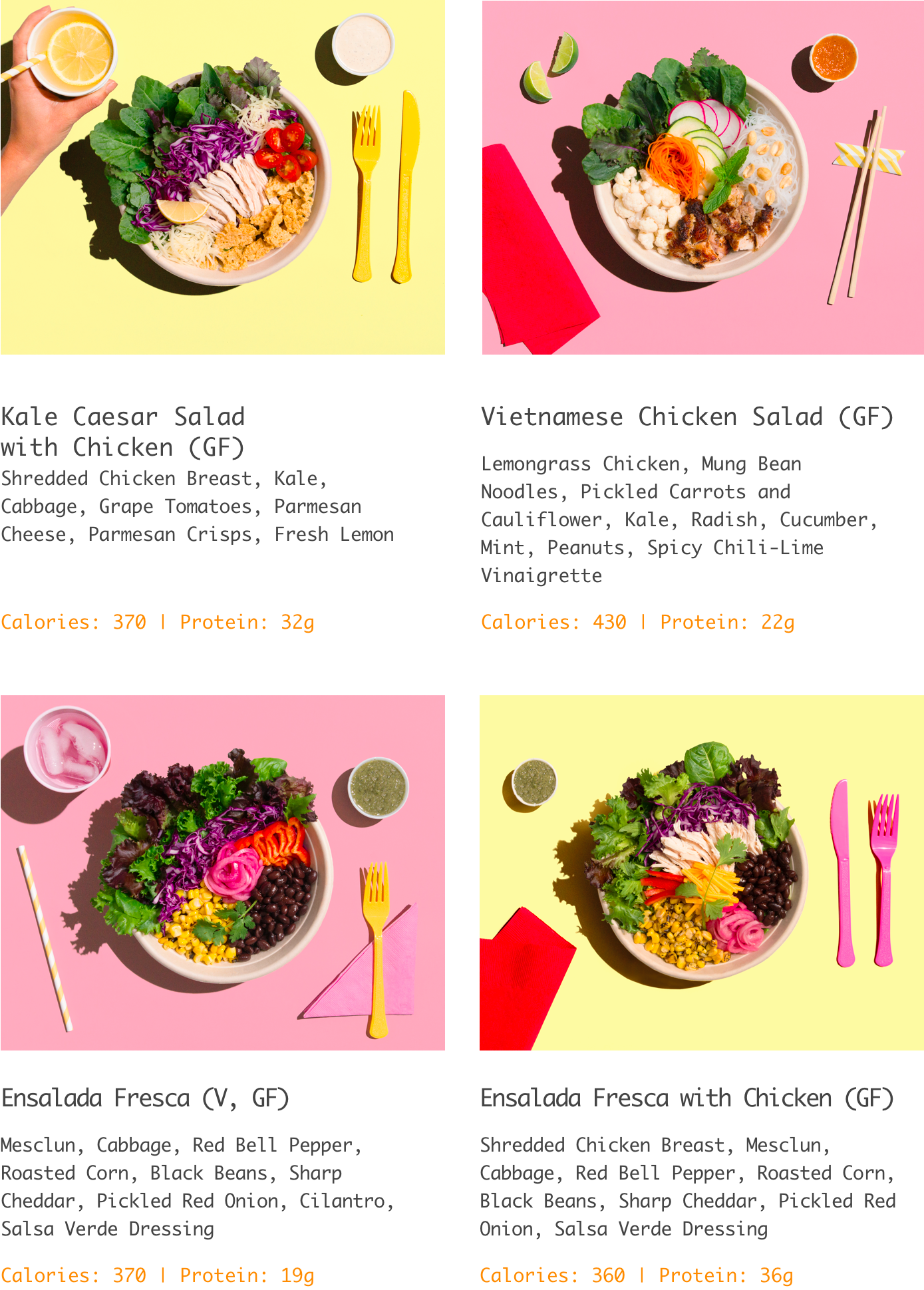

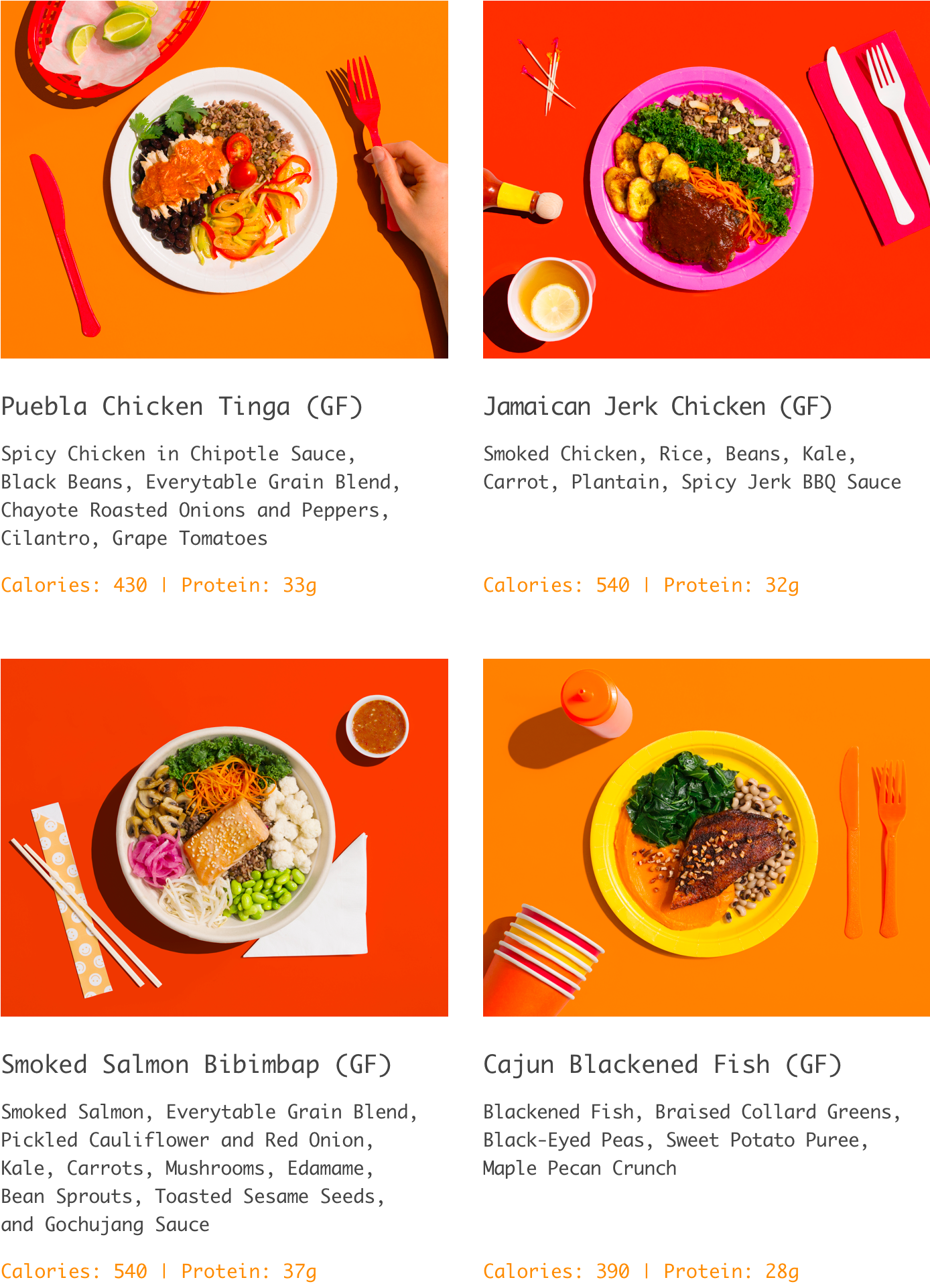

Salads & Grain Bowls

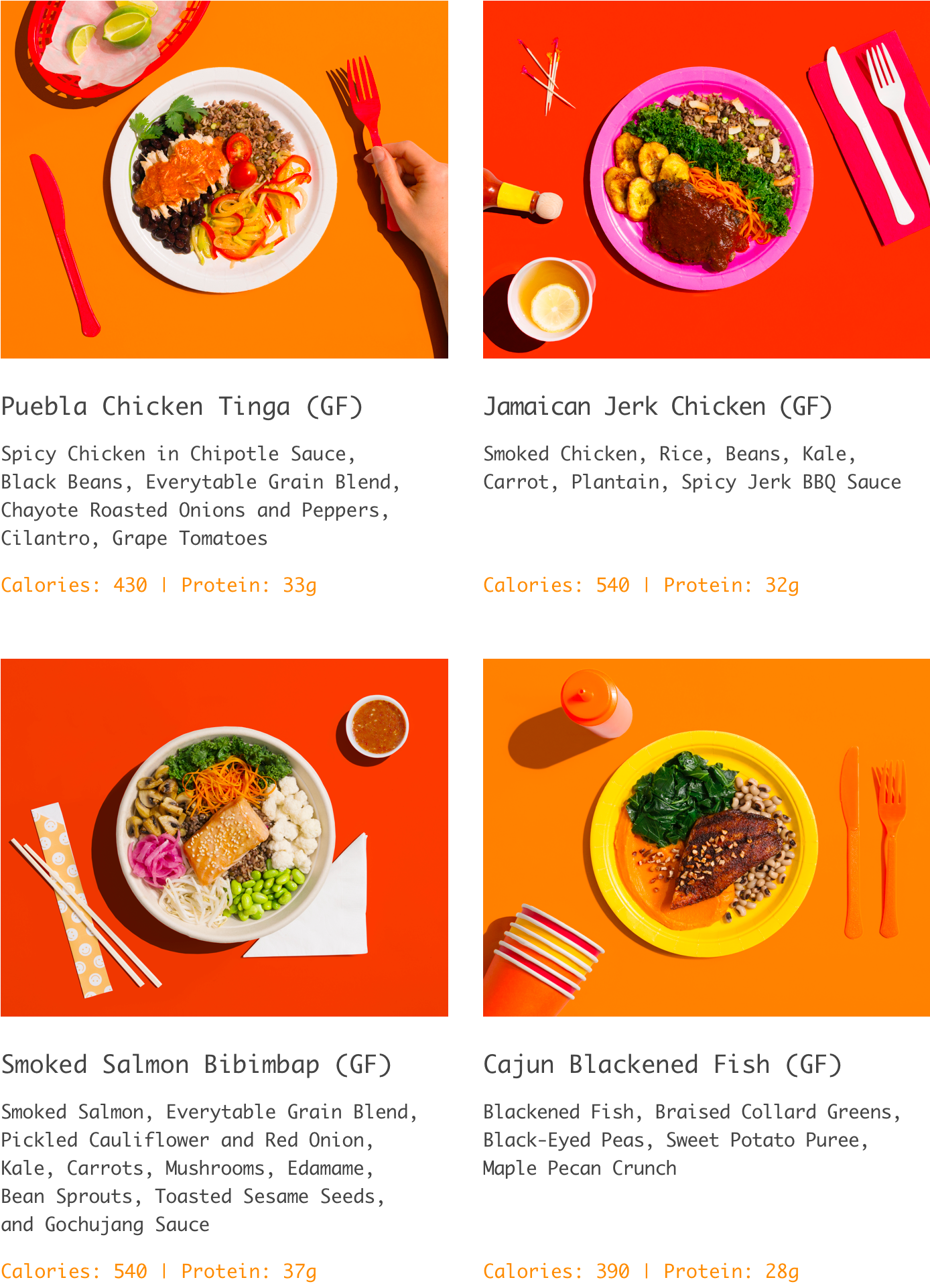

Hot Plates

Here's how we are making it happen:

Centralized production results in incredible efficiencies in the kitchen and makes our locations significantly cheaper to build and operate. They only need enough space to store our delicious food and can be run by a couple employees!

We have locations in food deserts and in affluent areas. To ensure that everyone can afford our meals, we price them according to the neighborhoods we serve.

Traction

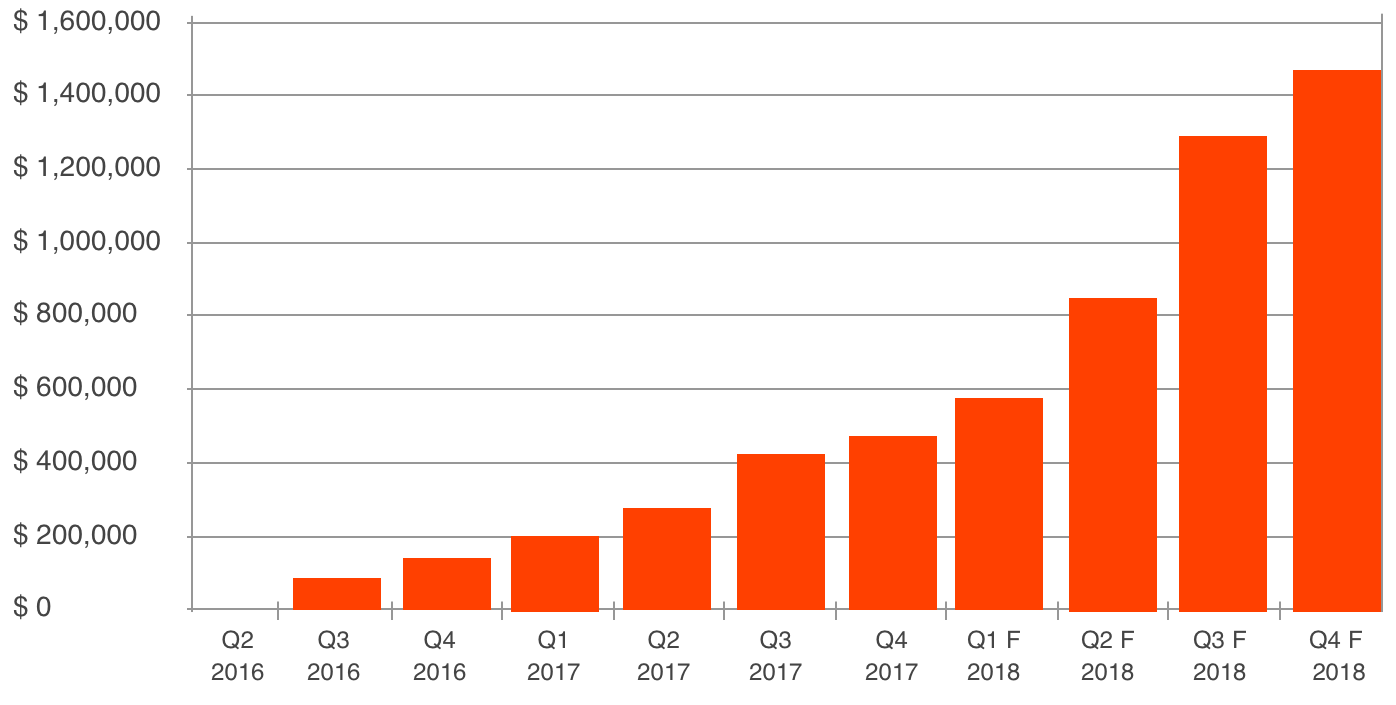

Quarterly Revenue

Yelp Reviews and Ratings

Press

Covered by 200+ Media Outlets: Over 2B Media Impressions

Investors

What's Next

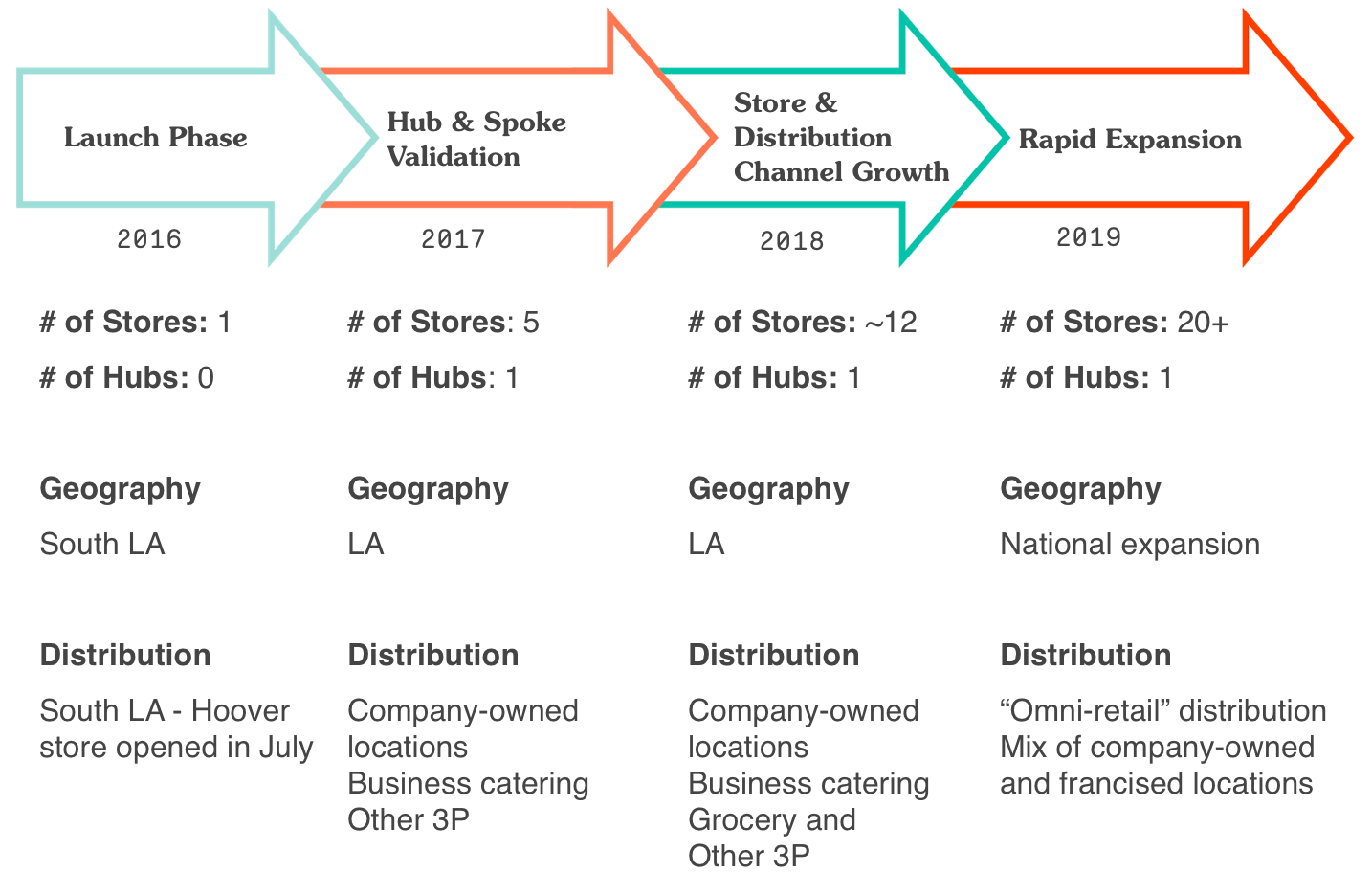

The above graphic includes forward-looking statements. Actual results may differ from forecast.

Founders and Team

Our Story

In 2013 Sam Polk, a former hedge fund trader, founded a nonprofit called Groceryships to address food-related health problems in South LA, where the average income is $13,000 a year, life expectancy is 10 years lower than more affluent areas, and diseases like obesity and diabetes are alarmingly high. Groceryships began helping family food providers make healthy choices through nutrition education, cooking classes, free produce, and support groups.

In 2014 David Foster, a former private equity professional, was so inspired by a Groceryships event that he decided to join the nonprofit full-time.

That year, Sam and David began hearing from Groceryships participants that while fresh produce was great, they often had to buy food on the go because they were juggling multiple jobs and large families. And in South LA, their only options were fast food.

Sam and David saw an opportunity to help families like these. So they created a model for a new company that would sell nutritious food in “food deserts” like South LA at prices competitive with fast food.

Groceryships was built on the belief that every life is equally important. Sam and David wanted this core value embedded in the new company, so they called it Everytable, reflecting a mission to bring healthy, affordable food to every table in the country, with no one left out.

Everytable, PBC was formed as a Delaware Public Benefit Corporation, which means that this mission is legally embedded into the company's legal structure.

Sam Polk, Co-founder & CEO

Sam is Co-founder and CEO of Everytable. He’s also the founder and Executive Director of the non-profit Groceryships. Prior to becoming a social entrepreneur, Sam was a hedge fund trader on Wall Street. After noticing families in low-income areas struggling with access to nutritious food, he started Groceryships, a non- profit working at the intersection of poverty and obesity. Sam’s memoir, For The Love of Money, was published in July 2016 by Scribner. He is a graduate of Columbia University.

David Foster, Co-founder

David is Co-founder of Everytable. David began his career in private equity and investment banking, most recently as a VP at Aurora Capital Group, an LA-based private equity firm. David has always had a passion for social entrepreneurship, which led him to volunteer for Groceryships and eventually join as the Director of Operations. He attended the University of Michigan and earned a degree from the Ross School of Business.

Anar Joshi, VP of Marketing

Anar is VP of Marketing for Everytable. Anar first gained extensive product marketing skills working with startups to build online consumer experiences. With a strong desire to create a lasting community impact, Anar began volunteering with the team in 2015, and later joined full time. Prior, Anar worked in advertising at BBDO Worldwide in New York and PayPal in the Bay Area. Anar is a graduate of University of California, Berkeley's School of Engineering.

Johnny Yoo, Culinary Director

A native of Los Angeles, Johnny Yoo brings exotic flavors and a deep understanding of the LA dining scene to the Everytable menu as Culinary Director. Chef Yoo’s interest in food began during his time living in Hawaii and experiencing the cuisine--so much so that when he returned to LA, he enrolled in culinary school. He began his career at Koi under Chef Rodelio Aglibot and spent the following 15 years in pursuit of honing his knowledge, skills, and experience in the kitchens of renowned chefs including David Myers (Sona), Brendan Collins (Melisse), Christopher Eme (Ortolan) and Roy Choi (A-Frame).

Join us!

Join us in reshaping the American food system to make nutritious, fresh food accessible and affordable for all.

Together we can make the world a healthier and more equitable place.

Deal terms

$30,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

10%

If a trigger event for Everytable occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

Everytable must achieve its minimum goal of $50K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Website Mention (with your consent)

- Digital Thank You + Website Mention (with your consent)

- Everytable Tote Bag + Digital Thank You + Website Mention (with your consent)

- $20 Gift Card + Everytable Tote Bag + Digital Thank You + Website Mention (with your consent)

- Gift Card for a Week’s Worth of Everytable Meals (10 meals) + Everytable Tote Bag + Digital Thank You + Website Mention (with your consent)

- Lunch with Founders + Digital Thank You + Website Mention (with your consent)

- Invitation to VIP dinner to Celebrate our Next Store Opening + Digital Thank You + Website Mention (with your consent)

- Meet the Team + Meal Prepared by Our Chef for You and the Founders + Digital Thank You + Website Mention (with your consent)

- Paid Flight Out to Meet the Team (up to $800) + Meal Prepared by Our Chef for You and the Founders + Digital Thank You + Website Mention (with your consent)

Why others invested

See all reviews (0) See all (0)I liked the idea/goal, and believe folks need this type of healthy fast food source. Good luck.

I have been eating the hearty food from Everytable for over a year now at their flagship (South LA) store. Coincidentally, I bask in their mission and am incredibly grateful to help extend their outreach, especially towards where they envision. It's also a genuine joy to regularly purchase ‘Pay It Forward’ meals every time. Their altruistic stance on consolidating affordability with superlative quality of nutrition is endearing on many fronts.

I invested because the food we eat today is processed, pre-packaged, and generally not good for us. Everytable will set a precedent on healthy fast-food. I'm excited to be apart of it.

About Everytable

Everytable Team

Everyone helping build Everytable, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC